Presenters:

- Laurent Harrison, CFP®, Senior Investment Advisor and Financial Planner

- Ryan Kelley, CFA®, Portfolio Manager

The transcript below has been edited for clarity:

2020 Election Update: What Investors Should Know

Webinar 10/22/20

Slide 1: 2020 Election Impact: What Investors Should Know

0:00 Laurent: Good afternoon, and welcome to Bell Investment Advisors’ “2020 Election Impact: What Investors Should Know” webinar. My name is Laurent Harrison. I’m a Senior Investment Advisor and a Financial Planner at Bell Investment Advisors. I’m joined today by Ryan Kelley, Chartered Financial Analyst and also Head Portfolio Manager here at Bell Investment Advisors.

0:22 Laurent: I’m really glad to be here with you today, given the election that’s coming up here in the next couple of weeks. We have a lot of information to share with you.

Slide 2: Webinar Overview

0:32 Laurent: Ryan?

0:33 Ryan: Thanks, Laurent. We want to discuss potential market impacts of a Biden or Trump win, history and examine some markets and elections (and if that’s influential), some Democratic vs Republican policies that may or may not impact the market, and the folly of betting on simplistic narratives with your investment decisions.

1:02 Laurent: I’ll be covering the “Investment Strategy Options, Explained”. That’s actually something that Ryan and I do back and forth as a team. A lot of clients will ask questions about emergency cash reserves, and there’s some best practices and things you can do currently that will help you either pre- or post-election. And lastly, there’s always a few activities and actions that you might want to think about and take in your accounts for Q4. And now, I’m going to pass it back over to Ryan and he’s going to take it away.

Slide 3: Increasing Chance of a Biden Win

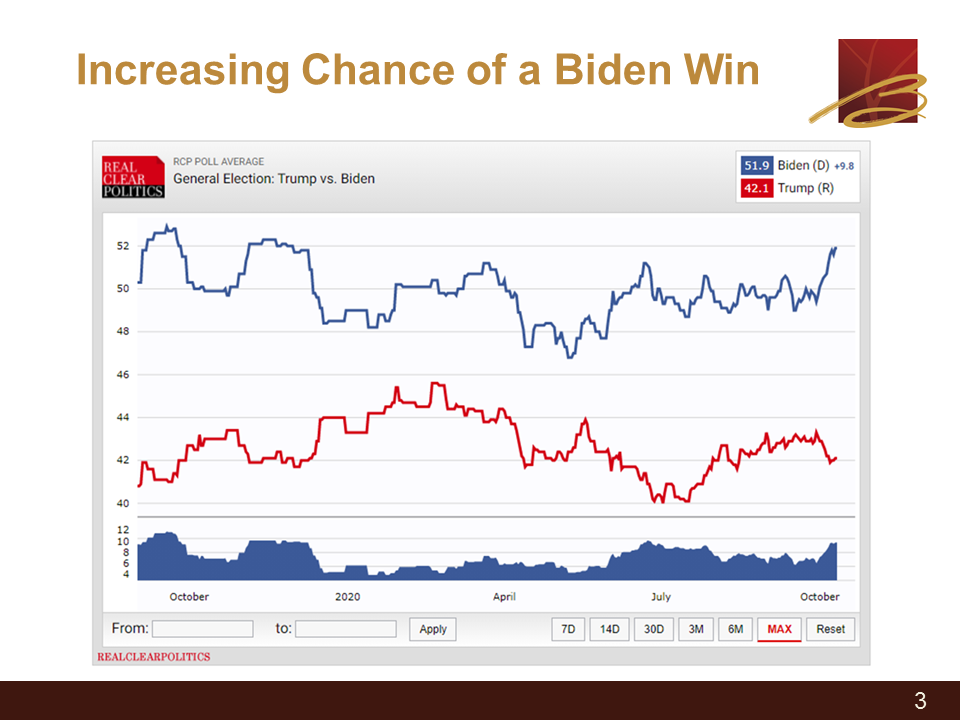

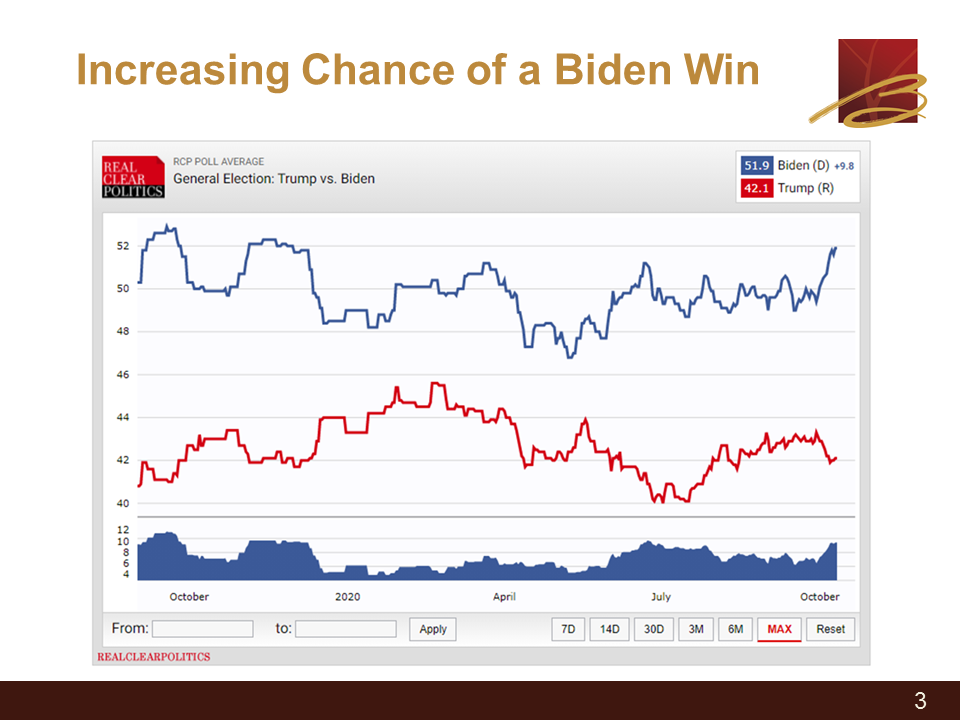

1:35 Ryan: Great, thank you. A lot of clients may be aware of this, but one of the things that’s obviously been talked a lot about is the probability of a Trump or Biden win in the upcoming presidential elections. Biden’s chances of winning have increased recently. This chart here is an amalgamation of different polls of who voters would likely pick for president.

2:05 Ryan: You can see that the sharp uptick in blue represents Biden, and downtick in red represents President Trump. I should also note that there is another way to look at this, and that is that instead of using polls, you can look at what’s called the prediction markets. You can see on the following page an example of this. But essentially, investors get to bet on who they think is likely to win. Their theory is that people are more honest with their betting, their money, than they are answering a poll. But you can look at the same statistic in the betting markets, and it does also reflect a higher chance of Biden winning. It has also increased. The advantage towards Biden is narrower than it is in the poll average.

Slide 4: But Control Depends on the Senate

2:53 Ryan: But what really matters is not just who wins the presidency, but we are talking who will be able to enact legislative changes. That’s also going to depend on who controls congress. Now the House of Representatives, from what I’ve read, is almost certainly going to stay with the Democratic party in control of it. So, it really comes down to, who is going to control the Senate? Right now, it’s under Republican control. This chart, from the prediction markets or betting markets, shows the chance of a Democratic control of Senate. Right now, it’s favored to flip to Democratic control. What I’d point out is that even if you control it, the amount I’ve read is maybe 51 to 55 at most Democratic Senators vs Republican. That’s obviously not enough to overcome a filibuster challenge. If you assume that if there is going to be a President Biden, for him to pass a lot of meaningful policies require the House of Representatives staying democratic, which is probably going to happen. As well as Senate, not just being under Democratic control but actually willing to repeal the filibuster rule, which has been dubbed the so called “Nuclear Option,” which could happen. But I would also point out that Mitch McConnell is unwilling to take such an action in the first two years of Trump’s presidency, when the Republicans did control the House, the Senate, and the Presidency. So, it’s not such a sure thing.

4:34 Ryan: If they are unwilling to repeal the filibuster rule in the Senate, then you are most likely to, at least in the first few years until the mid-term elections, not get much done policy-wise because it’s likely the Republicans would block most major political changes that the Democrats would want to pass for those first two years. Even if they don’t control the Senate, they would still have enough to get in the way.

Slide 5: Regardless, Markets are Rallying

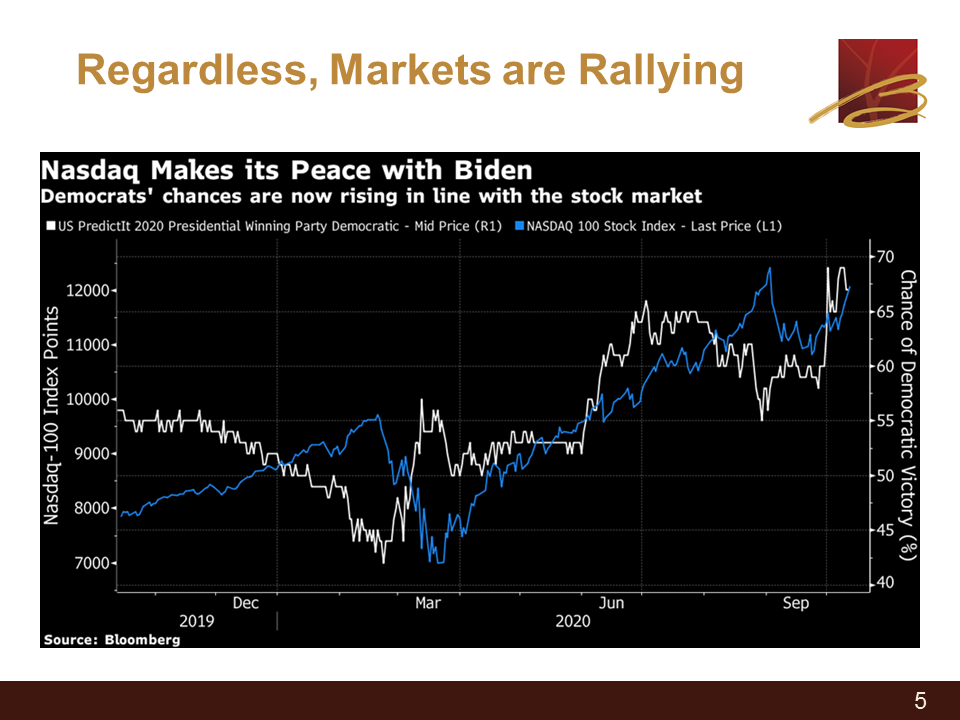

5:03 Ryan: One narrative I read about a lot, and some clients have heard or may believe, is that a Democratic win (if Biden wins the presidency) might be bad for stocks. That’s possible, but what I would point out here is on the chart, as his chances of winning go up (which is represented by the white line), the stock market itself in the U.S. has gone up. This is specifically looking at the Nasdaq, a tech heavy stock index. So again, his chances are going up and yet the stock market is going up at the same time. You could say that the stock market wants him to win, or you could simply draw the conclusion (which is more likely) that the impact of the election is just not that meaningful for the stock market. It’s focused on other things. Worst case is not all that concerned with him winning, if not outright favoring it.

Slide 6: 2020 So Far: Where do we stand?

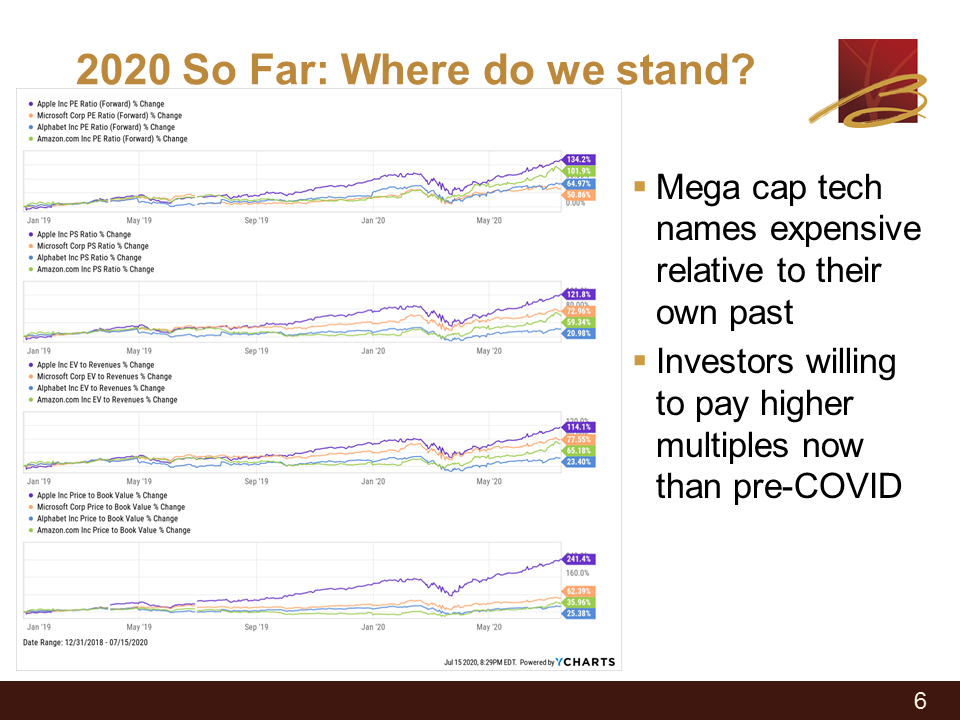

3:12 Ryan: I do want to point out one thing about this rally. I was showing you some of the tech names. None of the best U.S. performing names have been the mega cap tech names, but they still have done very well. This would be Google (or Alphabet Inc.), Apple, Amazon. Facebook’s not shown here, but Microsoft. These are making up a larger and larger percentage of the U.S. market.

3:41 Ryan: What I wanted to show clients here is that, what we are looking at is these four stocks, and I’m measuring them relative to themselves on various valuation metrics. So that’s price-to-book, price-to-sales, price-to-earnings, etc. What this is showing us is just saying whatever the price-to-sales was back in January 1, 2019 versus today. So if the line stays flat, the multiple hasn’t changed. If the line goes down, it’s gotten cheaper. But you can see pretty consistently across all four of these stocks, across pretty much all four of these metrics I have up here, it’s pretty clear that investors are willing to pay higher and higher multiples for the same dollar of revenue or earnings than they have been. Not only over the past few years, but even pre-coronavirus. Investors are now willing to pay even more for these mega cap tech names than they were before people even had heard of Covid-19.

4:52 Ryan: So that is a bit of worry and sign. It’s something that clients should keep in mind. That they want a more well diversified portfolio that’s not so heavy on some of these large cap tech names, which is generally how we do design our portfolios at Bell. Where we do small cap names, and international stocks, etc. To somewhat diversify away from some of this potential risk. I did just want to point out that within the market itself, there are a lot of disparities. Tech is leading the way, but does look to becoming more expensive, even relative to itself over the recent past.

Slide 7: A V-Shaped Recovery in a U-Shaped World

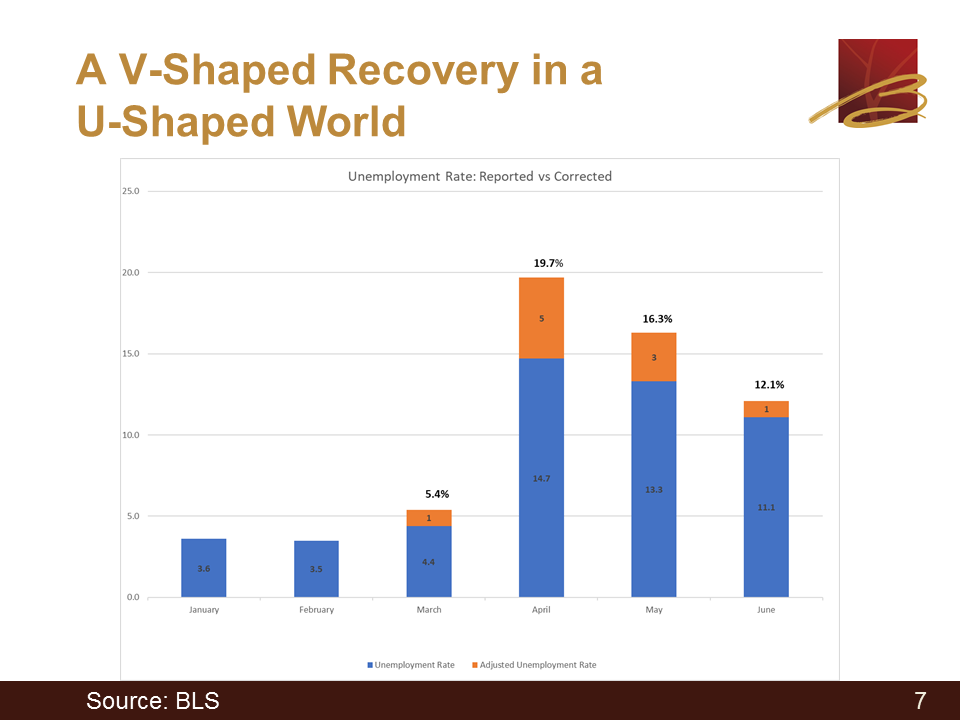

5:34 Ryan: As far as the economic recovery, as opposed to financial markets, we can update you guys on where things stand relative to when we did our last webinar. But what we see here is unemployment rate. Now, unemployment rate is based off a survey done in the middle of the month. Since the coronavirus happened, there’s been some category that used be a rounding error when they did these surveys. It’s actually a misclassification, but it’s become a larger and larger component of the surveys. So when the Bureau of Labor Statistics has released their official unemployment numbers, which are the blue bar and you can see the labels there. They do put a footnote and they say “If we adjusted out this misclassification error, here’s about how much higher unemployment would have been.” And this is purely from coronavirus.

6:33 Ryan: I went ahead and added back in this misclassification error rate to get the true unemployment, so to speak. You can see in April that we actually almost hit 20%. Since then we’ve come down to about 12%, which is certainly a pretty dramatic recovery. It’s about half of the coronavirus-induced gain in unemployment that we’ve now recovered. That does seem to be somewhat like a V so far.

Slide 8: A V-Shaped Recovery in a U-Shaped World

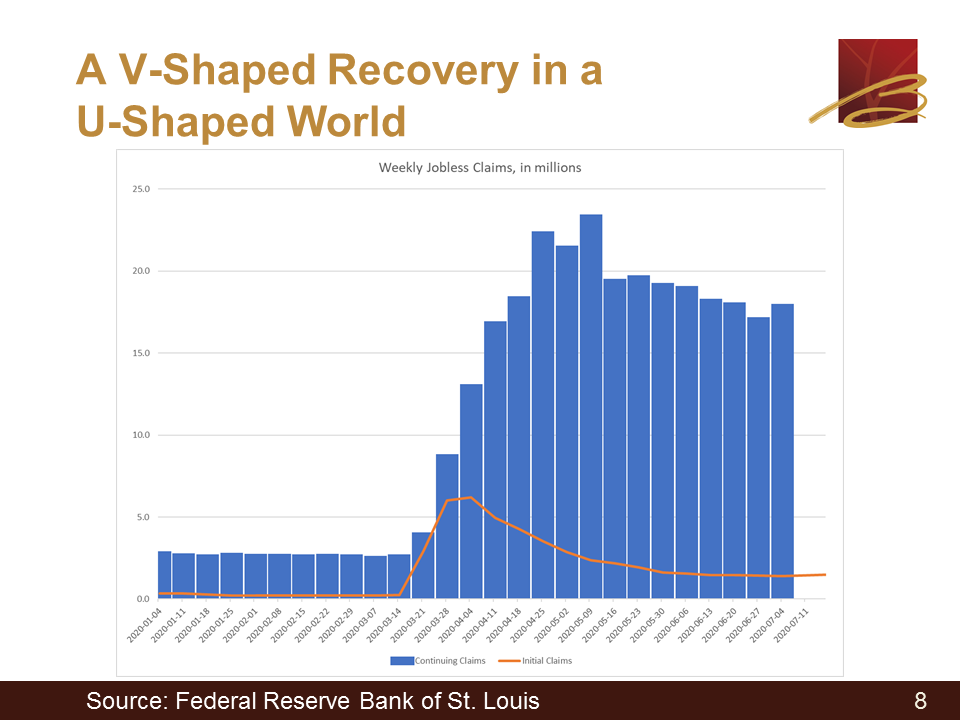

7:07 Ryan: But you’ll see here from the weekly jobless claims. The blue bar is showing continuing claims and the orange line is showing new initial claims. Just an alternative way to examine the labor market health. You can see that yes, these data series have improved. With the lower they get, the better things are here. The rate of improvement has slowed down. In fact, if you look at the newest data points, which may be a little hard to see especially on the initial claims, but they’ve actually gotten slightly worse. Either the rate of improvement has gotten flat, or actually in the most recent week it’s slightly upticked then deteriorated a bit. I think that is another sign that we are probably stuck in a U-shaped economic recovery. We did get the initial bounce back that I talked about in the last webinar, but things do seem to be slowing down.

Slide 9: A V-Shaped Recovery in a U-Shaped World

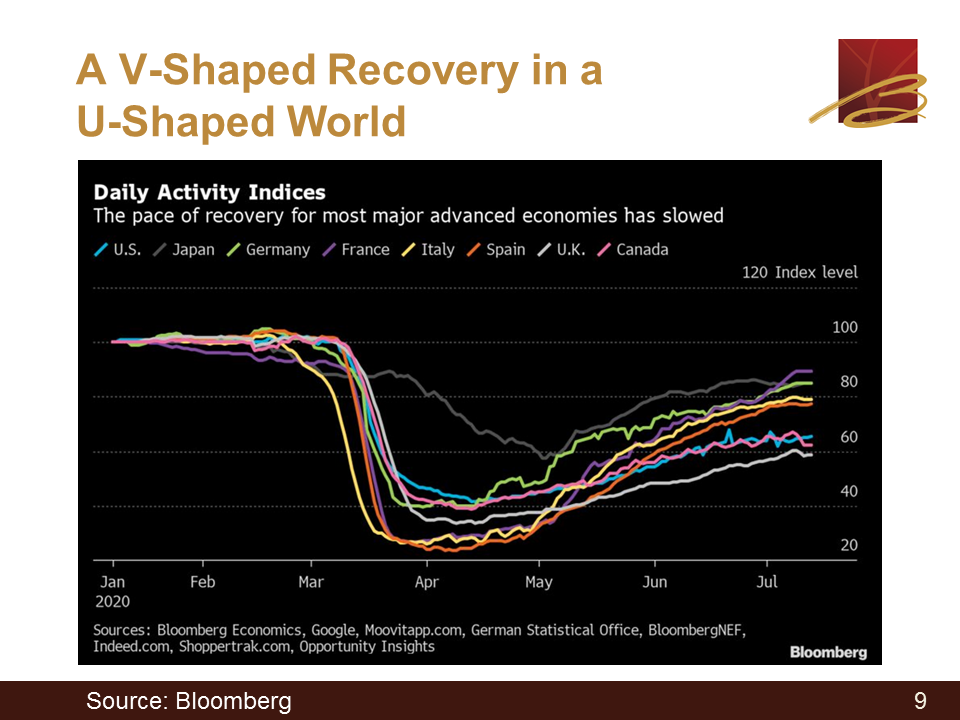

8:10 Ryan: You’ll see on this following chart. This is an activity index. It’s an amalgamation of different data series, and it’s pegged to 100 being the normal level as of January 1st of this year. You can see the various countries shown here, but a similar view. You can see things bottoming out at their worst around April. They recover. But if you look at the most recent data points, you can see these lines turn horizontal almost. The recovery seems to be slowing down now. In a few cases like the U.K. and Canada have actually ticked down a bit and become a little worse than they have been, so receding slightly.

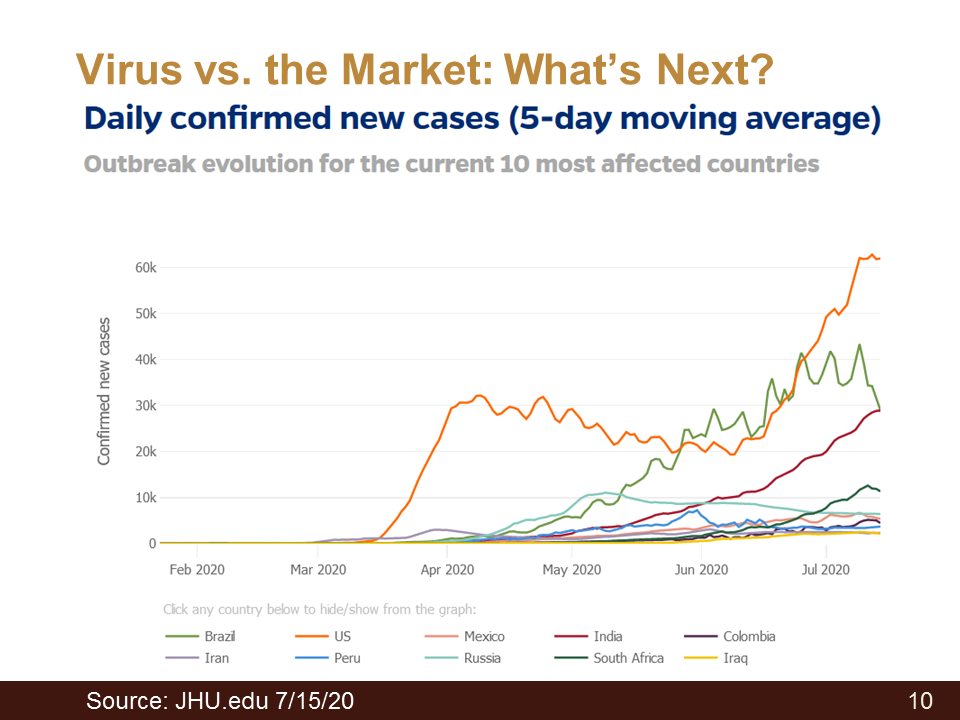

Slide 10: Virus vs. the Market: What’s Next?

8:59 Ryan: And of course, what’s driving all of this? It’s the coronavirus, specifically resurgence in some cases or even the initial wave in some developing countries. What we’re seeing here is daily confirmed new cases, the 5-day moving average. The orange line is the U.S. You can see that it was getting better. It never really got back down too low. Then of course, as no surprise to our clients, it’s making new highs. In fact, it’s about double the peak it was back in April. And of course as we read about in the news, the rollback of reopening restrictions. Bars are getting reclosed. Restaurants are being forced to reduce capacity or close altogether. Gyms are reclosing, etc. And of course, this is hurting the economic recovery as you see new restrictions get re-imposed.

Slide 11: Virus vs. the Market: What’s Next?

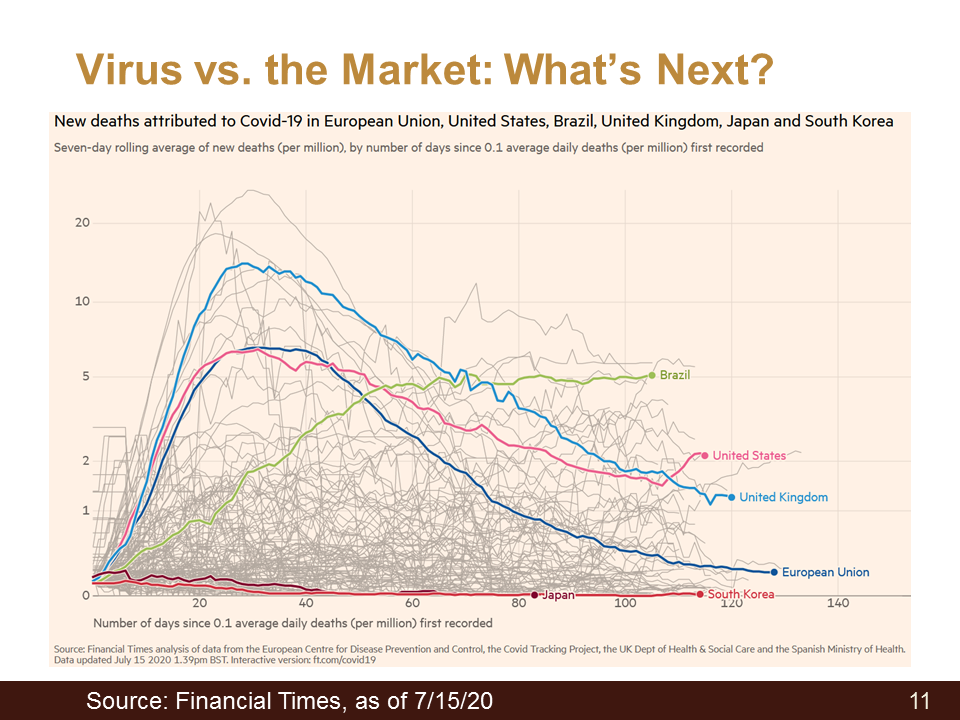

10:03 Ryan: What’s interesting is what we were just looking at is confirmed cases. If you look at the new deaths attributed to coronavirus, and this is adjusted for population size, you can see with the pink line is the U.S., and you see this overall hump across the European Union and U.K. You see Brazil, a developing country, has not been coming down. But within the developing countries listed here, you can see that there has been improvement. The U.S. has improved, but not nearly as much as the European Union. And now we’ve actually seen another uptick or worsening of deaths in the United States, and we’re clearly nowhere near as doing well as the European Union right now. So, certainly a troubling sign. You’ll notice at the very bottom there’s South Korea. It almost looks like a flat line. It would certainly be a much better situation to be in than we find ourselves now.

11:11 Ryan: People may ask, “well how can we have double the previous all time high of confirmed cases, but the deaths are nowhere near the all time highs?” There’s probably two reasons for that. One is that the type of people getting infected have become younger, and they survive it easier. But the other reason is that we probably had far more cases back in April that we knew about, but we just didn’t catch them through testing. Now, we are catching more cases through testing. We’re seeing a higher result because we just didn’t know how many didn’t get reported back then. On the deaths caused by coronavirus, we did have the uptick which is certainly worrying. But at least so far, there’s no guarantee that we won’t reach these previous records, but we are quite a bit better than we were back a few months ago.

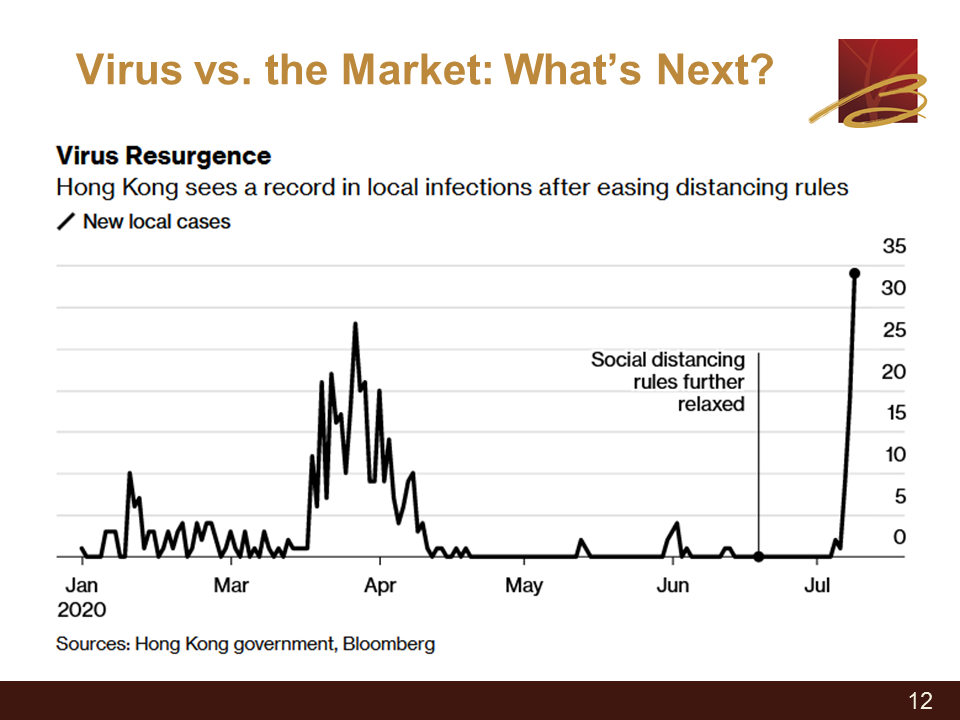

Slide 12: Virus vs. the Market: What’s Next?

12:10 Ryan: One thing to point out when I was talking about South Korea – and I do have Hong Kong here [as well], I could overlap the numbers with the Asian countries because they see a similar story. Some more Western countries as well. Even the countries that have done a remarkable job of containing the coronavirus are not necessarily out of the woods. Here’s Hong Kong, and you can see the first wave back in April that gets suppressed. I like to call this “smother the curve” as opposed to “flatten the curve.” You can see that they relaxed some rules after hardly any cases at all, potentially even zero detected cases. And then they get another spike. Note the scale though, because we are talking 30 people. This is clearly a very small amount of people, but the point is that they can’t let their guard down. They can’t go back to economic normalcy as long as there is some level of coronavirus, even if it’s two cases.

13:13 What Hong Kong did is they actually re-closed their schools, reclosed their gyms, reduced restaurant capacity, and still have a lot of people working from home. Even though they have done a remarkable job at fighting the coronavirus, you can’t go back to normal as long as it’s still around.

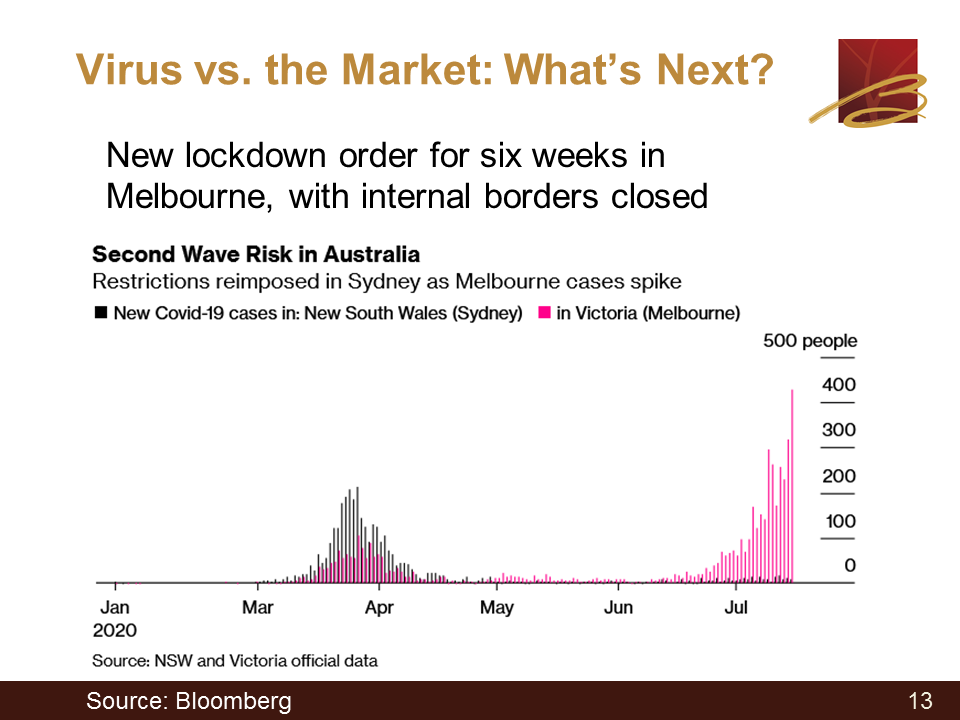

Slide 13: Virus vs. the Market: What’s Next?

13:35 Ryan: Here’s another example using Australia. You can see the number of cases in black back in April, with an overlaying pink as well. That was their first wave. Black was Sydney and pink was Melbourne. They implemented some restrictions and really managed to snuff it out. Never really 100% because it’s still there. They had about two months or so of pretty low level activity. Suddenly in Melbourne, you see things getting worse. Again, look at the scale. We are talking a few hundred people, not 70,000 cases like we see in the U.S. But to keep things that low, they had to reimpose some restrictions.

14:22 Ryan: There was a six-week lockdown order for Melbourne. It’s actually located in the state of Victoria, which now has internal border control, so there’s restrictions on traveling into or out of the state of Victoria to try and contain within a certain region of the country. It’s not a “oh, we’ve done a great job. Let’s go back to normal.” It doesn’t work that way because the virus never actually goes away 100%. There’s always some amount of it there. We’ve seen a resurgence, in lower levels, in Barcelona, Brisbane, and in a few other countries. The U.K. city of Leicester, they had to impose a four-week new lockdown after they had a resurgence. It’s not that you’re out of the woods when you’ve managed to get a good result. You have to maintain the vigilance to stay there. Unfortunately, part of that vigilance is economic restrictions.

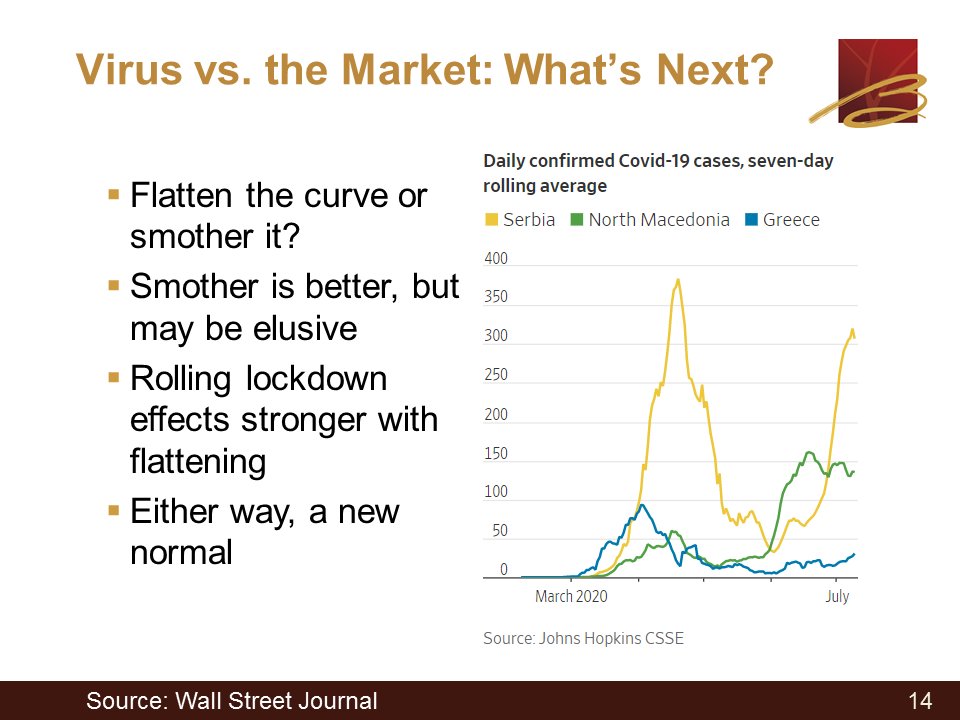

Slide 14: Virus vs. the Market: What’s Next?

15:21 Ryan: One last chart. This is showing Serbia, which had a big spike. Again, big relative to the scale (a few hundred). But they did implement a really severe lockdown. Actually, most of Europe, if you look at the lockdown that they had relative to the U.S. rules (even when we had something at all), was much more strict. You had to get a permit just to go shopping. Police would stop you to make sure you were shopping at the store near your house and not on the other side of town, so it was a much more severe experience. So, they had a lockdown and they managed to “smother their wave” down pretty close to zero. They loosened their rules, and unfortunately probably too far. They allowed sporting events and some political rallies, and then they got another resurgence. When the government wanted to reimpose the strict lockdown, the people were not having it. There was a lot of civil unrest against the government. There were riots outside of parliament because people could not go back to living like that a second time, and potentially maybe even a third or fourth time. We don’t know. So it shows there is some backlash against some of these restrictive policies if they’re not successful.

16:46 Ryan: France has said that France has done a good job suppressing their cases. They’ve said “if we have a second wave, we’re not going to have a national lockdown again.” Most will have regional targeted efforts, but we’re not going to lockdown all of the country again in a strict manner because it’s so corrosive to their society and their economy to do that. So it is somewhat of a worrying trend that even the countries that have done a good job, that not only do they have to stay vigilant because there is no guarantee that things that won’t spiral away from them. We’re not sure what the corresponding measures will be a second time. It’s somewhat of a tricky political decision.

17:30 Ryan: Compare that to what’s going on in the U.S. We don’t seem to have a comprehensive strategy. It’s more fragmented regionally, and not always well broadcast what the intent even is. But we seem to be following, as best as I can tell, to “flatten the curve” which was the original idea, allowing cases and assuming everyone’s going to be infected sooner or later. Trying to control things so the hospital systems don’t get overwhelmed.

18:00 Ryan: But in either case, you’re probably going to be stuck in using economic restrictions as somewhat of a throttle in a car. It’s like hitting the gas or backing off the gas in an effort to either completely smother cases down to a pretty low level, or just keep them below a level that would overwhelm your healthcare system. I would expect going forward that we will see more news about this, and certainly in California. We have heard from the governor that they have re-imposed restrictions and gone backwards so to speak. Either way, we’re going to be stuck in this new normal until a vaccine comes out, most likely.

18:41 Ryan: So with that, let me turn things over to Laurent and he will discuss market conditions, what you may or may not want to do with your portfolio as a response to the current situation.

Slide 2: Webinar Overview

18:52 Laurent: Great, thank you. What I’d like to talk about in the time that remains is really taking advantage of the current market conditions. It’s really an opportunity to take a look at your portfolios and investments, and make a slight modification if you felt pretty uncomfortable during the downturn.

Slide 15: Taking Advantage of Current Market Conditions

19:16 Laurent: The downturn in stocks, which started in February or March, and then we see the bounce back happening. It’s really recovered, as Ryan has shown you. Large cap stocks in the U.S.. are almost fully, if not a little bit above that. Certainly technology stocks have done amazingly well, although almost too well. It’s a little bit scary. There’s a lot of articles that reference back to the late 90’s and what was going on then. But that remains to be seen.

19:48 Laurent: It’s important if you are thinking about making a change to see how the U.S. companies are doing in terms of earnings. Well unfortunately, the earnings forecast for the last half of 2020 are really going to be challenging. A lot of businesses essentially announced that they really wouldn’t provide guidance for especially Q3 and possibly for Q4. It’s really hard to use earnings right now to make a decision. U.S. stock market valuations is another metric that you might look at, but it’s actually pretty high vs. historical averages. In fact, right now the S&P 500 index has a price-to-earnings ratio (which is a reflection of how expensive stocks are) which is really above 21. I have 20 in the slides, but it’s really 21 and change. The five year average is 17, and the ten year average P/E is 15. You really are paying some pretty expensive prices for stocks at the moment.

Slide 16: Taking Advantage of Current Market Conditions

20:49 Laurent: If you are going to take advantage of the current market conditions, and possibly make a change to your investment risk, smaller investment changes are definitely better. We strongly encourage you to talk to your lead advisor about that. To help you with that process, really ask yourself three different questions. The first of them would be “do you have a fairly long investment “time horizon” ahead of you? Meaning, before you need those funds. Do you have five or ten years in front of you before you need those retirement assets? Or, are you retiring in a year or two and should really rethink those investment risks, now that you have an opportunity to rethink that.

21:38 Laurent: Number two, does your financial plan support lower investment risk if you have a formal financial plan? Lastly, and this is really important, would another sharp market downturn cause you so much discomfort as to make you request a move to cash? If that’s the case, you probably need to have a discussion with your advisor now, and possibly look at it again as either a slight or some reduction in risk to your investments.

Slide 17: Taking Advantage of Current Market Conditions

22:05 Laurent: The bottom line though is that you really have this opportunity, given the strong bounce back. You saw mostly with U.S. large caps, but it’s also occurred in other areas of the market. The opportunity is to do a slight modification to your portfolio, and down the risk curve if you are feeling super uncomfortable. However, if you weren’t feeling uncomfortable and you were able to weather it (and that does take some discipline), then your best course of action would be to stay the course. On that note, the next couple of slides have to do with the staying the course vs. market timing.

Slide 18: Staying the course vs. “Market Timing”

22:43 Laurent: What I thought we would do in the time left today is talk about “market timing” because you hear a lot about that term. You talk to your advisor, and your advisor might say “if you want to go to cash, that’s really market timing.” What does that really mean? Market timing is really a type of investment or trading strategy. It’s actually the act of moving in and out of a financial market, between stocks and cash or stocks and maybe bonds. Between asset classes based on predictive methods.

23:18 Laurent: Now predictive methods is important because most market timers that are doing this, maybe with tools or etc., are using some sort of technical market indicators or economic data to gauge how the market is going to move. If you are just feeling emotionally that the market is just too high, or feeling emotional that the market is low and it’s a good time to jump in, that’s probably not the best market timing strategy to use. If you are using a lot of technical indicators, and you are doing your homework, perhaps you will be a little bit more effective at it.

Slide 19: Staying the course vs. “Market Timing”

23:49 Laurent: However, being effective at it is really up for discussion because most investors, academics, and financial professionals (including Bell Investment Advisors) believe it is really next to impossible to time the market. Others, like active traders, mostly believe that they can do that. However, what is really true is that it’s extremely difficult to time the market consistently, over the long run especially. I looked up some pros and cons to market timing just to share a little bit with you on that. I will say more often than not, it’s been the case with us, meaning when we’ve had clients who have chosen to market time (go to cash before a market downturn or try to enter back into the market at a low), almost always the timing has not been optimal for those clients. We’ve talked to other firms and advisors who have said the same thing.

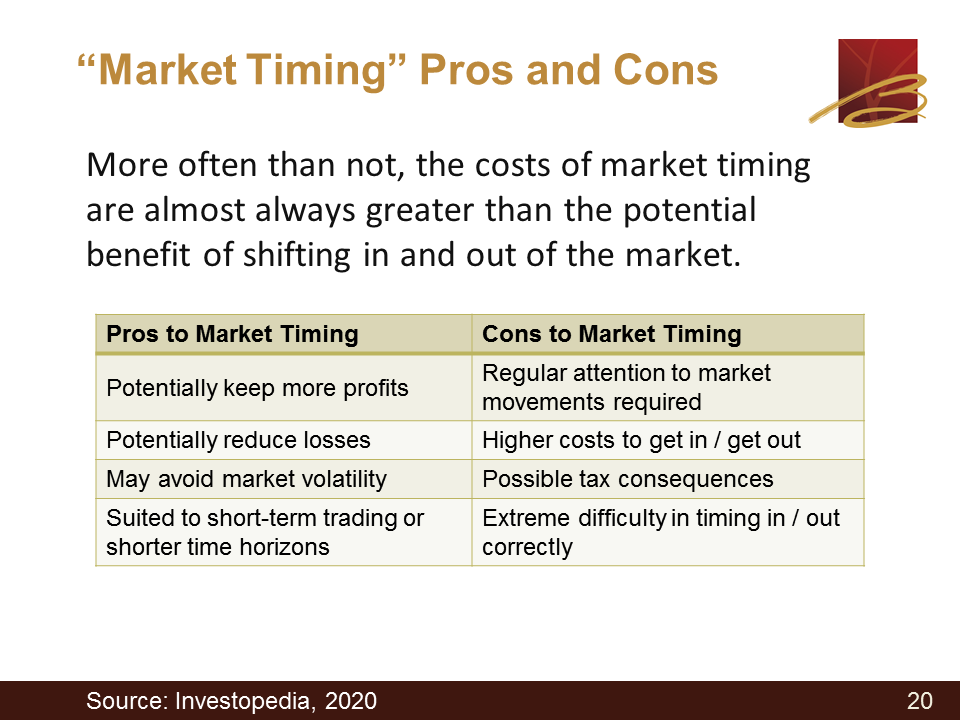

Slide 20: “Market Timing” Pros and Cons

24:53 Laurent: The pros could be potentially keeping more profits and reducing your losses, but really it’s fairly suited to short term trading and really short time horizons. You’re thinking about in a month or two, then you’ll get back in. If you are out for a year or two, you’ve probably “missed the boat” so to speak. The cons to market timing, and there are a few, are that you really don’t want to try and do that with taxable accounts. And lastly, there is extreme difficulty in really timing when to get out and when to jump back in.

Slide 21: Staying the Course

25:31 Laurent: And on that note, there’s an interesting study from DALBAR on investor behavior. Again, if you aren’t using some pretty sophisticated technical indicators and you’re really basing it on emotion. It’s interesting to note that between 1995 and 2014, using the S&P 500 index as a gauge, you would have earned about 10% annualized return if you would have stayed 100% invested. That would have been a really, really tough time to stay 100% invested, unless you had a really long time horizon and literally didn’t look at your investments during that time. However, you would have made 10% annually. If you would have tried to time the market and you would have only missed ten of the best days in the market during that time, your returns would have gone all the way down from 10% to 5%. The takeaway is that some of the biggest upswings in the market occur during super volatile periods when a whole lot of investors might actually want to time the market and jump out. That’s something to think about with market timing or staying in.

Slide 22: Staying the Course

26:42 Laurent: The moral of the story is the best option is really to stay the course for long term performance. It does require some discipline, stamina, and the ability to weather stock market volatility. A couple of tips to do that is avoid looking at your portfolio during those volatility days, up or down, too often. In the last webinar I talked about taking a statement vacation for the summer, then maybe extending that through the second half of the year.

Slide 23: Conclusions and Summary

27:16 Laurent: Just a couple of things to keep in mind. I do encourage you, if you are feeling super uncomfortable during that market downturn and you were able to weather it through, you do get a second chance to talk to your advisor and maybe reduce your risk a little bit. At this point, I’m going to turn it back over to Ryan to talk about conclusions and summary from today’s webinar.

27:39 Ryan: Great, thanks Laurent. Clients should expect continued market volatility. One thing I didn’t mention when we were looking at the disparity between tech stocks and financials and non-tech stocks is that there’s a reason these stocks haven’t recovered. That’s that these stocks have a lot of pessimism surrounding their year term prospects. It’s not predicted that everything is to be rosy, and certainly a lot of events could still take place and there’s still a lot of unknowns with the virus and how long it could last. Also, new economic restrictions, etc. So, we should be prepared for more volatility, especially since we do seem to be in a U-shaped recovery, at least as far as we can tell. The longer it drags out, the longer we could see more volatility and more financial stress in certain corporations.

28:47 Ryan: Having said that, things by and large have recovered quite a bit. So if you did feel nervous during the worst times of the downturn, now is an opportunity to dial back the risk if you feel it’s prudent, and not be selling low. We do also encourage clients to think long term as well. It looks like stocks are probably going to outperform bonds over the next ten years, so staying the course will give you the best result especially with short term interest rates being close to zero. Finally, the virus is still creating a lot of challenges to the economy. There will be winners and losers with that, so it’s something you need to be prepared about. We’ll have to take it one step at a time.

Slide 24: Conclusions and Summary

29:41 Ryan: I also want to mention that we are here to support you. You can always contact your advisor if you have any issues or feel concerned about something, or if you feel your portfolio may be out of line with adjustments in risk tolerances. Here at Bell, we are operating very effectively remotely. We do usually hold three meetings a week with the entire company, as well as monthly regularly scheduled meetings that we are used to doing in the office. Everything has been operating very smoothly, and we don’t see any reason why the virus would cause us any hindrances in fulfilling our duties. I also just wanted to thank everyone, and I hope you guys have a wonderful second half of 2020. With that, let me turn things back to Laurent.

Slide 25: Have Questions?

30:32 Laurent: Great, thanks Ryan. Just the last couple of slides here. If you did have any questions, you can submit them via the Go2 webinar window, and we will plan on responding to those questions post webinar. You can certainly contact us after the webinar for any questions, or to schedule a portfolio review.

Slide 26: Upcoming & Recent Webinars

31:02 Laurent: Here is an upcoming or recent webinar list. We had our previous one in May, and the one today. We will probably have one more in October or November, probably related to the election coming in November. We do have a library of those.

Slide 27: Stay in Touch!

31:18 Laurent: We encourage you to very much stay in touch, obviously via email or call. Check out our website. One point to note is that today’s presentation slides will be available in about a week upon request, so we can email you those when they become available. Both Ryan and I want to let you know how much we appreciate you being a part of our webinar today, and we wish you a safe and sound latter half of 2020.