As a native San Franciscan, I find it odd that earthquakes as small as ones that register 3.0 or 4.0 on the Richter scale make news. As far as I’m concerned, that is hardly a shake at all. But then I remind myself that the Bay Area is filled with transplants from other parts of the country and globe where earthquakes do not occur as frequently or at all. For many of these folks, there can be a lot of uneasiness caused by a little shake because they have not had the same amount of exposure to earthquakes that those of us who have lived in the Bay Area for a long time have. For what it’s worth, I’m sure I’d be in a complete panic at the first sight of a funnel cloud.

Recently the U.S. stock market had some turbulence of its own. In August, the S&P 500 Index underwent its first double-digit pullback (a.k.a. “correction”) in four years. While the dearth of volatility over the last four years created a pleasant environment for investors, it also makes that 10%+ decline all the more frightening as it has been a while since we have had to deal with one.

The Frequency of Stock Market Corrections

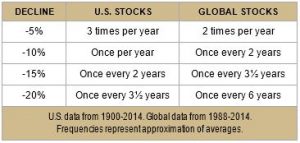

Analyzing stock market data as far back as 1900, Capital Research and Management Company (proprietor of American Funds) determined the approximate frequency of market pullbacks in the United States and globally. Here are their findings:

The first thing to note from this data is that double-digit corrections happen with some degree of frequency — once per year on average in the U.S. and once every two years for a globally-diversified portfolio. So going four years without a 10% pullback is a bit unusual relative to history. As a result, double-digit stock market -corrections should be expected and accepted by equity investors. It simply comes with the territory.

The second thing to note from this data is that corrections in a globally-diversified portfolio occur less frequently than in U.S. stocks. There is a reason for this: diversification. Opening up your portfolio to the stocks of other countries that are denominated in other currencies smooths out the ride as they do not move in unison. Global diversification is one way to lessen the frequency of corrections on your portfolio. Adding bonds or other alternative assets that are not highly correlated to stocks is another.

The Effect of Stock Market Corrections on Your Retirement Plan

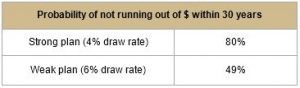

The effect that a double-digit correction in the stock market has on your retirement plan depends on a number of factors: the initial strength of your plan, how many years you have left in your plan, and how exposed your portfolio is to the stock market. But for the sake of illustration, let’s say that we are looking at retirement plans with 30 years left that are fully-invested (100%) in the stock market. The only difference from the two hypothetical plans that we are looking at is the strength of each — one plan tests positively because of a low draw rate (4% per year) while the other plan tests poorly because of a high draw rate (6% per year). Here is how those two plans score prior to a stock market correction:

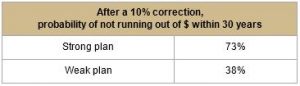

Now let’s assume that the stock market corrects by 10%. If we shave 10% off the portfolio values but leave the withdrawal amounts the same, here is how the two plans score after a correction:

While the probability of success of both plans drops, the strong plans remains strong and the weak plan weak. It’s also notable that the probability of success of the strong plan drops less than that of the weak plan.

Along with diversifying into foreign stock markets, bonds and alternative investments, shore up your retirement plan if you want to limit the effect that market turbulence has on it. Just don’t wait as long as they did to shore up the eastern span of the Bay Bridge after the 1989 earthquake.