-

Financial Market Returns

-

The U.S. and Global Economies

-

Tariffs — Current Status & Impacts

-

Debt, Inflation, & the “Big, Beautiful Bill”

-

Questions from Clients

Bell Investment Advisors Webinar June 2025

From Policy to Portfolio: The Economic Impact of Tariffs

Note: This transcript has been edited for clarity and context.

Slide 1: From Policy to Portfolio: The Economic Impact of Tariffs

Slide 2: Presented by:

00:00 Laurent Harrison: Good afternoon, everyone. My name is Laurent Harrison. Welcome to today’s webinar. I’m a Financial Advisor and Principal at Bell Investment Advisors. I’m joined today by Ryan Kelly, our lead portfolio manager and Chartered Financial Analyst for Bell.

0:23 Ryan Kelley: Hello, glad to be here today.

0:26 Laurent Harrison: Great. Today we are presenting a webinar entitled “From Policy to Portfolio: The Economic Impact of Tariffs.” If you do have a question, please submit via your questions bar. And while we’re not answering them on the webinar today live, we’ll definitely follow up individually with you after the presentation.

Slide 3: Today’s Webinar Agenda

1:42 Laurent Harrison: We have quite a bit on the list today. We’re going to try to get this webinar done in about 30 to 40 minutes. We generally make it 30 minutes. But given all that’s been going on, both in the U.S. and abroad, we thought we would take a few extra minutes today. Hopefully, that will be OK.

2:04 Laurent Harrison: Today, we’ll be covering topics [in] various areas, including both the U.S. and global economic events. Ryan’s going to take us through both domestic and global updates. Next, he’s going to move us into tariffs, which have been a hugely popular topic over the last few months since President Trump and the Republicans took over on January 20th.

2:36 Laurent Harrison: The financial market returns we’ll cover fairly quickly because we still want to have time in the agenda to cover a little bit on debt, inflation, the legislation currently going through both houses of Congress, known as President Trump’s “Big, Beautiful Bill.”

2:53 Laurent Harrison: And then we have some typical questions that clients have been asking over the last few months. We took those and I’m going to do a Q&A with Ryan using those questions.

Slide 4: U.S. and Global Events – What a Year

3:08 Laurent Harrison: Without further ado, I’m going to jump into the first slide here, and I’m going to cover the next two. What a year so far, with the change [in] administration [and] new legislation going through Congress. We’ve seen new conflicts, unfortunately, abroad and old conflicts escalate or continue.

3:32 Laurent Harrison: President Trump has implemented varying amounts of tariffs. We’re actually going to talk to you about that in detail. Actually, Ryan’s going to talk to you about that in detail, about what it is and the impact that it’s having currently on both the U.S. and abroad.

3:50 Laurent Harrison: This is also not necessarily the tariffs, but President Trump and his policies have certainly impacted the federal government in which we’re seeing a lot of departments with both shutdowns and layoffs. So all this is being done with some rather, what we would say “unique methodologies.” But, it is what it is, as we all like to say.

4:13 Laurent Harrison: In terms of the conflict side, we continue to have Russian-Ukrainian conflict with little sign, unfortunately, of it abating. And last weekend, we did see the U.S. enter the Iran-Israel conflict, albeit a very quick in and out, per President Trump and the communication we’ve been hearing about it.

Slide 5: Iran-Israel War Update – Potential Impact

4:39 Laurent Harrison: So more about the U.S. involvement in Iran and likely Iran’s response as of today. As I mentioned, there was an attack on Iranian nuclear facilities this past weekend. There was a lot of talk back and forth with diplomacy as the number one focus leading up to that. And unfortunately, that was done. Apparently, it was a success per President Trump.

5:11 Laurent Harrison: Then on Monday of this week, he immediately declared a ceasefire. And then yesterday, [President Trump] just stated that the U.S. would hold the meeting with Iran next week, but he did cast doubt on the need for a diplomatic agreement on the country’s nuclear program. [This was] based on the fact that his statement was that Iran’s nuclear program was set back either months or years.

5:36 Laurent Harrison: War and military conflict truly is horrible, in terms of human terms, but clients do often ask the Bell team what impact it might have on markets. At a high level, likely what we’ve seen, at least in the past, is these conflicts usually stay regional. Iran, which is a very large country in terms of population, has been impacted by various limits to their ability to ship their oil worldwide and do other things. So, they don’t really have a material impact on the global economy and profits.

6:19 Laurent Harrison: During these conflicts, we have seen both global research, innovation, and revenue continue, so we’re not really seeing a material impact. But again, Ryan’s going to cover that in a little bit more detail.

Slide 6: Iran-Israel War Update – Potential Impact Cont’d

6:35 Laurent Harrison: And then lastly, before I pass it back over to Ryan, [is] the possible response and impact. We actually did the research on this earlier this week. And since it’s a fast-moving topic and situation, it appears that number three right now is essentially what is happening, which is a return to the negotiating table, both Iran, the U.S., and even Europe, is talking about diplomacy at the moment.

7:04 Laurent Harrison: We are seeing in terms of markets and price, oil, which had spiked in response to the recent conflict, has certainly returned to the price it was. So, there are relatively few signs of market anxiety at the moment. With that, I’m going to turn it over to Ryan to talk about both domestic and global economic update.

Slide 7: U.S. Economic Report: Output and Jobs

7:29 Ryan Kelley: Great. Thank you, Laurent. I would say [it has] teed up at a high level, without going into any of these specific bullet points. We haven’t really seen much impact from tariffs yet. We’ll talk about tariffs later on. But, if you were to have fallen asleep in January, woken up today and you looked at financial markets, you looked at economic data, you wouldn’t really notice anything monumental has happened. For example, GDP grew 2.5% percent last year. The Federal Reserve is predicting it’s going to grow 1.6% this year.

8:11 Ryan Kelley: That’s our latest forecast from the meeting they just concluded last week. Unemployment remains low. It’s hovered in the high 3’s, now 4.1, 4.2 range month after month this year. And every single month this year, we’ve had a net new amount of jobs added, totaling at least 100,000, sometimes nearly 200,000, month after month.

8:37 Ryan Kelley: Another sign of continued strength in the labor market, continuing claims and initial claims for unemployment insurance remain very low. You see no signs of deterioration there. And profits are forecast to grow 5%. I should say, U.S. corporate profits are expected to grow 5% this year.

9:00 Ryan Kelley: So at a high level, we don’t really see any deterioration in data. We’ll see market returns in a bit. They did deteriorate. I’m sure everyone’s aware. But, right now, we’re pretty much positive across the board. So things are still looking good on that front, at least where we stand today.

Slide 8: Global Economic Update

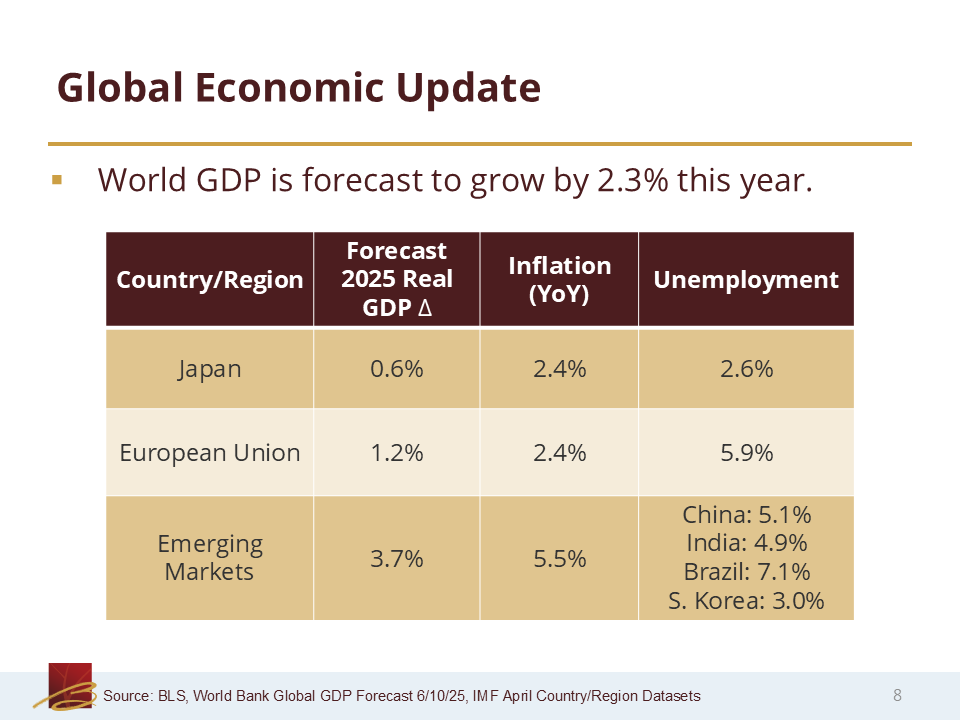

9:20 Ryan Kelley: If we turn our attention to the next slide, we’ll see that this is not just a U.S. phenomena. This is a World Bank forecast as of, I believe, June 10th. The World Bank is forecasting globally [that] GDP is going to grow 2.3%. These [GDP] numbers are always inflation-adjusted. So, 2.3% this year. That’s not a screaming high number, but it’s fine. It’s positive.

9:49 Ryan Kelley: And then in the table, these numbers are coming from the International Monetary Fund forecast, mostly from April. But you’ll see there are pretty solid positive numbers across the board. Inflation, for the most part, remains subdued. [It’s] actually similar to our last data release we saw in this country, 2.4% for Japan and the European Union.

10:13 Ryan Kelley: Then, unemployment is low and fairly typical for the different countries and regions listed here. There’s not a single emerging markets unemployment number, but you can see fairly solid GDP growth expectations, higher inflation (which is normal), and then broken out by some [of] the larger, more important countries in the investment benchmark for emerging markets, I broke out unemployment.

10:39 Ryan Kelley: But really nothing (at least if these forecasts come true or that the current data stays roughly stable regarding inflation and unemployment) [suggests] signs for concern globally, either. So, things still look fairly healthy abroad, not just here in the U.S.

Slide 9: Tariffs – The Current Status in the U.S.

10:59 Ryan Kelley: If we turn our attention to the next page, I’ll switch focus and talk a little bit more about tariffs. Just at a high level, tariffs are a tax on foreign goods that are imported into a country. In this case, we’re discussing foreign goods being imported into the United States.

11:18 Ryan Kelley: And then the U.S. government is placing an extra, almost like a sales tax, on top of that. That revenue is then collected by the federal government, the same as income tax or something else of that nature. This just counts as general revenue.

11:34 Ryan Kelley: As I’m sure everyone knows, President Trump has been implementing tariffs, pausing tariffs, adjusting tariffs, threatening tariffs this entire year. The process has been, I don’t know what word I want to use, but not smooth and not orderly. And even right now, we’re still not really clear where some things will shake out.

11:58 Ryan Kelley: We’ll see on the next slide in a second, some of the current status, but that is an evolving, moving target, so to speak. But generally, tariffs have an effect that’s negative. The question is: how negative? But, they generally increase prices [and therefore, inflation], and they generally reduce economic growth to some degree. Probably the key point, maybe on this entire presentation, is the 90-day pause.

12:29 Ryan Kelley: We’ll discuss market returns later on, as I mentioned, but markets had risen through February, declined sort of at the end of the first quarter, and they really declined on the so-called “Liberation Day” announcement, which was in early April. Only a few days later, there was a complete reversal with this 90-day pause to give time for negotiation to occur on the tariffs that had been announced, and that led to this really sharp market spike to reverse much of the declines that had occurred previously.

13:04 Ryan Kelley: Well, that 90-day pause is scheduled to expire in just a few weeks. What happens after is anyone’s guess. So, we’re sort of in this calm period. We could see maybe another 90-day pause or maybe we’ll see more threats issued. We don’t really know at this point. But a lot of the calmness in markets is really due to this 90-day pause that was announced.

13:27 Ryan Kelley: The other thing we’re looking at [is] tariffs from the U.S. point of view. Well, there’s a reason they call it a trade war, because oftentimes when one country implements tariffs or taxes on foreign goods being imported, the corresponding country responds in kind and places tariffs on your goods.

13:45 Ryan Kelley: So, there’s already been a few measures in Canada, [as] one specific example. But there’s some countermeasures already placed on our goods being exported, most likely to be further retaliatory measures, depending on how some of these negotiations go or what happens after the pause.

Slide 10: Tariffs – The Numbers

14:06 Ryan Kelley: Next slide. So that’s at a high level, but looking at some specific numbers and examples. This first whole point comes from JP Morgan. They estimate that this tariff rate (or tax rate, if you want to think of it that way) that the average tax or tariff being paid collectively across the amount of goods we import is about 15% right now. So it’s a meaningful [number], but it’s not sky high.

14:37 Ryan Kelley: As far as what we’re charging other countries that are importing [goods] to us right now, there’s [a] kind of a generic 10% minimum tariff that applies. But there are some specific exemptions or discounts, as we’ll see. Auto and auto parts, there’s actually a 25% tariff on them. There’s a 10% exception for the U.K. because they have reached one of the first trade deals with the U.S. That’s why they are getting a discount right now.

15:12 Ryan Kelley: China generally has a 55% tariff, but this is a really fluid process. There technically hasn’t been a deal yet. There’s just been a lot of negotiation. There’s some news that came out recently. There may be additional details and news next week, but we’ll see.

15:32 Ryan Kelley: There’s specific product [tariffs] as opposed to country tariffs, just like on autos. There’s also [tariffs] on steel and aluminum, [at] 25%. And then certain countries, namely Canada and Mexico, because there’s a previous trade deal that was negotiated by Trump called the USMCA, which is basically the successor of NAFTA. Products that are certified under that deal are exempt from all these tariffs, so far.

16:01 Ryan Kelley: There’s some specific product exemptions, such as on consumer electronics, cell phones, I believe TVs are part of that. Even though they should otherwise be facing some level of tariffs, they’re just not. For example, if there’s a 55% tariff and your iPhone’s coming from China, the iPhone as of right now has been exempt, so it’s not getting hit with the tariff.

Slide 11: Tariffs – The Impact

16:27 Ryan Kelley: As far as what is the impact on that? I’ve previously mentioned at a high level [that it] has some reduction in growth and some increase in prices, but the magnitude is open to debate. There’s also a lot of behavior shifting that happens as well. Consumers may just buy less of the tariff products. They may switch to domestic substitutes. They may switch to another imported product facing a lower tariff rate.

16:59 Ryan Kelley: For example, if China has a 55% tax, maybe they can import the same thing from Korea at a 10% tax. And so [consumers will] shift where they order the certain imported product from. Another thing that’s happening, at least in the short term, this is our estimation, is that there was a rush to import a lot of products prior to these tariffs. No one knew exactly what the tariffs were back in March, but they knew something was coming. So, there was a huge rush in the first quarter to import a lot of inventory to escape any new taxes and tariffs.

17:37 Ryan Kelley: And so a lot of inventory came in, companies were able to sell this to us at a regular price because it never was hit with the tariff in the first place. But eventually that inventory is going to get worked through. Suddenly, [companies are] about to get new inventory at the higher tax tariff price and they’re likely to pass on some, if not all, of those cost increases on to consumers.

18:02 Ryan Kelley: There’s also this idea that, [because this tariff situation is] so fluid and it’s really open to debate what the ultimate tariff rate will be settled in on, that companies (even though they’re facing some tariff costs right now) may be hesitant to raise prices in the short term. If there is some future relief, they don’t want to anger their customers by increasing the price on some products, hurting their sales, and then the tax goes away and they then try to cut their prices, but maybe the customers don’t come back.

18:38 Ryan Kelley: There may be some activity of firms [that] are facing the taxes, but they’re just hesitant to pass the costs along in the short term. But in the long run, they’ll have to or just stop selling those products. Maybe the other thing that happens. So again, this generally has an inflationary effect, but yet our last reading (based off May’s prices), we saw a 2.4% year-over-year consumer inflation number. [It’s] one of the best ones we’ve seen since the pandemic started.

19:14 Ryan Kelley: [With] inflation, we haven’t seen any increase whatsoever from these tariffs yet, but I will say there are market mechanisms that try to price out what inflation might be. If we look at that, we are seeing basically a [3.2]% predicted inflation this winter. So there is an expectation that eventually these tariffs will trickle through to prices and boost inflation. I wouldn’t say [3.2%] is a huge number. In fact, that’s a fairly benign number that we saw not that long ago without any tariffs whatsoever.

19:51 Ryan Kelley: And then the market prediction is after that peak of 3.2%, we would see then a decline back to more normal inflation numbers. So there’s an impact, but it doesn’t appear, at least right now, to be massive. But then again, people are having to guess what the actual tariffs will be. It’s somewhat of a shot in the dark on this. I mentioned that [with] a lot of the data, it’s hard to see the impact of tariffs.

20:21 Ryan Kelley: The one thing I’ve seen the biggest impact on so far is corporate profit estimates for U.S. companies. There’s a company called FactSet that polls analysts and aggregates their earnings estimates. What was expected in March for second quarter corporate profits for the S&P 500, collectively they’re expecting the year-over-year growth of about 9%. Post all these tariffs coming into play and some caution and hesitancy on corporations to invest, they’ve now lowered that to about 5%.That’s definitely a meaningful reduction. It’s not catastrophic or anything, but [in] my personal opinion, that seems to be the biggest evidence I’ve seen [of] the impact of tariffs.

21:10 Ryan Kelley: On a final note regarding tariffs, everything that’s happened is using a certain legal authority, which is questionable. There have been some court cases to challenge President Trump’s authority to impose tariffs, since tariffs are taxes and constitutionally taxes are supposed to be implemented by Congress. He has lost the first round already, but it’s going to go through an appeal. It’s going to go to the Supreme Court, and even if [they] decide [that] President Trump, you’re not allowed to do this, they would only be ruling on one section of the law that has allowed him to do it. There are other sections of that or other laws where he could still pursue tariffs, just in a slightly different way.

21:54 Ryan Kelley: So, even if the first legal battle results in an ultimate defeat at the Supreme Court, it will just then trigger another mechanism and yet another legal battle. Ultimately, at the end of the day, it may be that presidents don’t have power to impose tariffs the way they’re being imposed. But the legal answer is not going to come anytime soon.

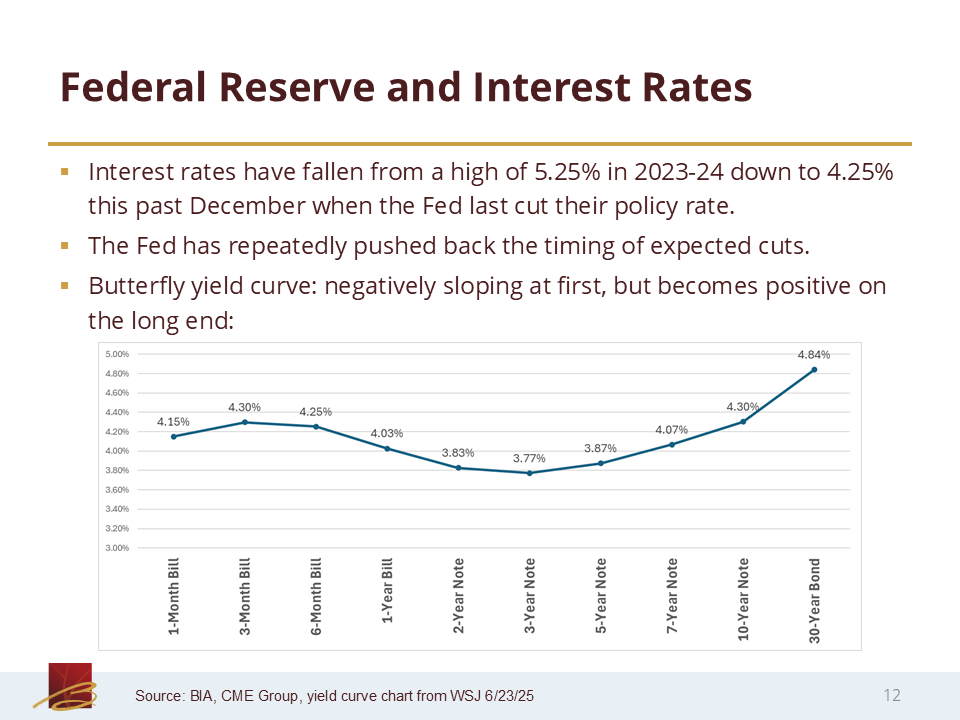

Slide 12: Federal Reserve and Interest Rates

22:21 Ryan Kelley: Speaking of inflation, which we know is connected to interest rates in the Federal Reserve. As a brief review, we had the post-COVID inflation [and the] Fed responded by raising rates quite a bit. They raised their short-term rate to a peak of 5.25% in 2023 and this lasted all the way through part of 2024. They began a cutting cycle and in December of 2024 was their final cut and they cut things down to 4.25%. So, they reduced basically 1% from the peak short-term interest rate that they set.

23:04 Ryan Kelley: Since then this year, we just concluded a meeting about a week ago, they have done no changes whatsoever. They just held firm and kept the same rate. They’re waiting on data to come in. It’s interesting because the data suggests they should be cutting their interest rate, because inflation, as I mentioned, is 2.4%. That generally would dictate a lower Fed interest rate policy.

23:31 Ryan Kelley: But because [the Fed is] concerned about inflation rising to some degree with these tariffs, they have decided to just sit and wait, and see what happens. They have indicated they’re likely to do two more cuts this year, so about 0.5% lower, which would put us at 3.75%. But that is data dependent as always, so if the data looks better or worse than what might be expected, we may get less cuts or more cuts. We’ll just have to wait and see.

24:04 Ryan Kelley: What’s interesting is there’s been this idea that, persistently, the Fed was about to cut, and the market’s been wrong, and they keep having to push forward their expectation of cuts. But what that’s left us with is this yield curve chart. The yield curve shows the amount of interest that U.S. Treasury pays on different maturities of the bonds that they issue.

24:30 Ryan Kelley:You can see we’re in this weird situation with almost like a butterfly, where it starts inverting as you go from short to medium term. Rates actually go down. And then as you extend farther out, they start to rise again. So we have a negative slope from short to medium, but a positive slope from short to long, which is not a normal situation, but it’s an expectation of where the Fed might be headed, as well as some uncertainty tied to potential inflation resurging or debt issuance increasing, etc.

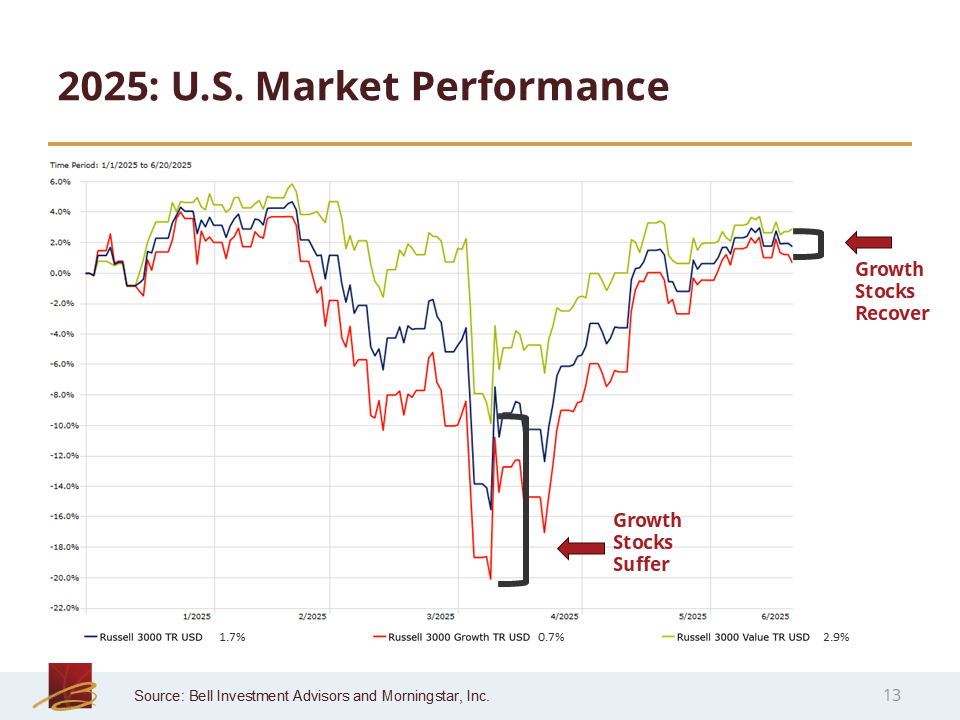

Slide 13: 2025: U.S. Market Performance

25:14 Ryan Kelley: We’ll turn our attention quickly to market performance. What I really want to show in this chart is the blue line, the U.S. stock market this year as of last Friday. The red line is the same U.S. stock market but only looking at growth stocks and the green line is looking at U.S. value stocks.

25:35 Ryan Kelley: I mentioned [that] if you had fallen asleep in January and woke up yesterday, you wouldn’t have realized much had happened this year. The U.S. market is up about 2% or so. As of right now, there isn’t much difference between growth stocks or value stocks. But if you went to the peak of the drawdown that happened after the Liberation Day announcement and the market panic sell-off, there was a huge gap of about 10% that widened between growth stocks (that just got crushed) compared to value stocks.

26:10 Ryan Kelley: And then with this 90-day pause, everything recovered, but the growth stocks recovered even harder and managed to shrink most of that gap. U.S. value stocks have been winning pretty much the entire year. It’s just the magnitude wasn’t that much at the beginning, then it became massive, and now it’s not much different anymore. So it’s been a wild ride, but the point A to point B is roughly flat, which is interesting.

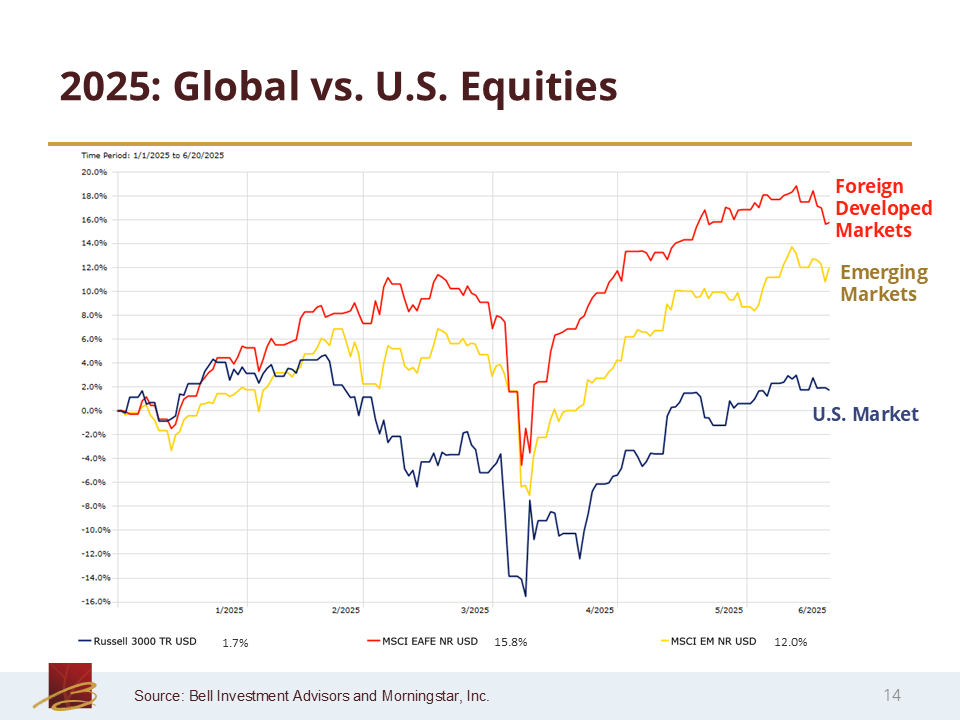

Slide 14: Global vs. U.S. Equities

26:37 Ryan Kelley: What hasn’t been roughly flat this year, though, are international markets. I labeled them here. U.S. market, again, is up about 2% as of last Friday. You can see both emerging markets and foreign developed market stocks have done quite a bit better. We’re seeing double-digit returns on both of those benchmarks, trouncing the U.S. market this year.

27:04 Ryan Kelley: What’s interesting is (that we’ll see on the next slide) that a lot of this is currency, but this is really a reversal of what we saw last year. Last year, the U.S. stock market crushed international stocks. This year, international stocks [are] the mirror image of it, where they’re suddenly doing quite well. It’s been quite a while since we’ve seen international stocks really beat the U.S. stock market by quite a bit.

27:31 Ryan Kelley: 2022 was the last example I can think of, and that was really a bad sell-off year for everything. It’s just U.S. stocks lost a lot more in that year, and a lot of that was due to the growth stock sell-off, kind of what we saw in April of this year. And the international stocks or U.S. value stocks – where you can see those growth type investments – all were negative, but it was a lot smoother ride. So that’s where we see things.

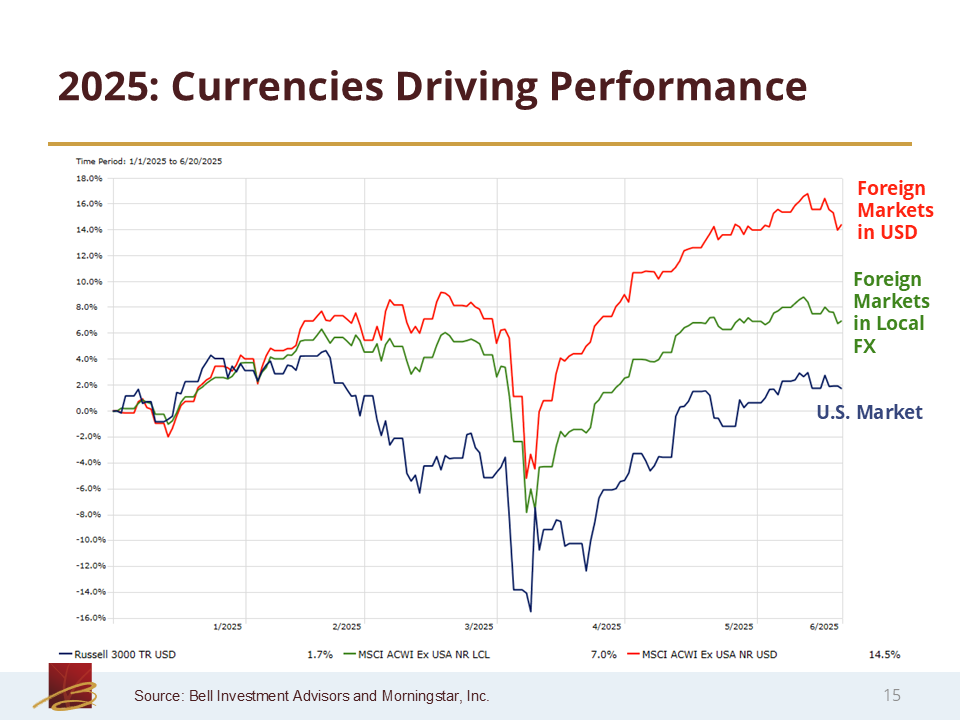

Slide 15: 2025: Currencies Driving Performance

27:59 Ryan Kelley: But as I mentioned, if we go to the next slide, we’ll see that much of the advantage [of] foreign stocks this year has actually come from currency movements. In green, we’re looking at foreign markets. There’s the global market, ex-US. And this is the result you would get if you had no currency movement whatsoever in green.

28:20 Ryan Kelley: You can see there’s some advantage, about 5% outperformance, built in the U.S. market. But once you include the U.S. dollar weakening this year, that outperformance jumps to about 12% or so. So, much of the gains this year have [been] driven by U.S. dollar weakness, about 7% or so. What we saw last year was another 7% gain in the U.S. dollar. A lot of the weakness that came last year in international stocks was just the U.S. dollar appreciating.

28:52 Ryan Kelley: And now we’ve seen almost the exact opposite, almost the same size move, just unwound this year with the U.S. dollar weakening. And I’ll point out [that] a lot of that gain actually came around President Trump’s re-election, when things really got extreme as far as U.S. dollar strengthening and the U.S. market beating International. Most of that outperformance came really at the very end of last year.

29:20 Ryan Kelley: What we’ve seen this year is the opposite. International stocks have pretty much dominated this entire year. Everything sold off during the Liberation Day drawdown, but they’ve never lost their lead. And it’s really just grown due to currency movements. It’s a big, big part of it.

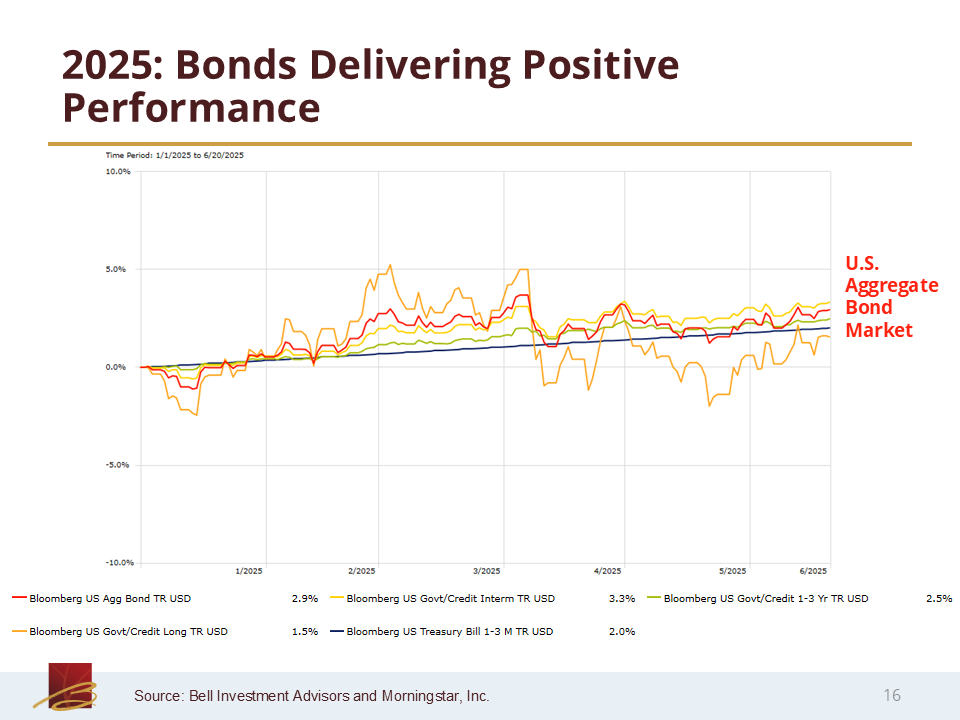

Slide 16: 2025: Bonds Delivering Positive Performance

29:43 Ryan Kelley: Next slide, please. We’ll turn our attention to the bond market. We’ve been discussing stocks. I like what we’re seeing. As we know, bonds shouldn’t deliver huge, huge gains. Hopefully, they don’t deliver huge losses. But this year, we’ve seen about 3% or so gain. That’s pretty solid, since we’re about halfway through the year.

30:07 Ryan Kelley: The red line is the overall U.S. bond market. Each of the other lines is some segment of that, but I just broke it out to show that it’s really been positive across the board. Some segments have done better than the average, some less, but it’s been a relatively smooth ride. And we’ve just logged in our interest coupon payments month after month, and we’ve managed to log in a few percent return in six or so months. For bonds, that’s pretty good.

30:41 Ryan Kelley: I would say that, if things continue with interest rates not just staying where they are, they don’t have to go up or down. We could easily see a 5% a year in the bond market, given that we’re at 3% already. Another 2% seems very achievable if interest rates don’t rise precipitously.

31:03 Laurent Harrison: Ryan, real quickly, before we go on [to] the next slide, and I take folks through legislation updates. Love to hear that you expect bonds to do better over the next five years, but what do you think they’re gonna do this year?

31:17 Ryan Kelley: I’m sorry, I covered what I thought they would do this year. Let me cover what I think they’ll do over five years. That is a great question.

31:23 Laurent Harrison: Okay, sorry about that, go ahead.

31:28 Ryan Kelley: There’s a very tight relationship over a five-year period between your current starting yield on a bond portfolio (assuming that you’re investing something like the overall U.S. bond market or intermediate term or so). [There’s a] very tight relationship between your starting yield and your analyzed return over the next five years.

31:48 Ryan Kelley: Given that our starting yield is somewhere above, let’s just call it 4.5%. That means there’s a (not a guarantee) but there’s a very strong chance that you will get over the next five years something similar to 4.5% annualized year after year after year. And you can graph this. You can look at what is the starting yield and what was the ultimate return achieved. It’s a very tight relationship. It’s not perfect.

32:17 Ryan Kelley: Probably the worst case would be rates rising a lot, then you would see deviation on the downside where your return wouldn’t live up to your starting yield expectations. But it’s a very tight relationship in general. I think clients who stick with bonds and are okay with that type of level of return and stability, [will] be very pleased with the ultimate result in five years from now.

32:45 Laurent Harrison: Excellent, thank you for that. Given where we are in the webinar, we’re gonna speed up just slightly here. We’ve just got a few more slides and then we’ll be wrapping things up. So far, it’s been very informative. Thank you so much, Ryan.

Slide 17: The “Big, Beautiful Bill” – Review & Update

33:01 Laurent Harrison: So let’s move on to the “Big, Beautiful Bill,” which refers to the tax legislation currently going through both houses of Congress. It’s interesting to note that the Senate Republicans want to pass a permanent version by July 4th. The House actually passed their version a couple weeks ago. Without going into too much detail in what it does, there’s essentially the Tax Cuts and Jobs Act (TCJA), which was passed during President Trump’s [first] administration in 2017.

33:38 Laurent Harrison: President Trump has made that his signature legislation and he wants those tax cuts, which were temporary and were scheduled to end this year. He wants those tax cuts to be permanent. He’s really pushed both houses to have something done sooner versus later. Unfortunately, both houses have a very different idea.

33:58 Laurent Harrison: The Senate modifications, in fact, may be so different than the House version that it actually may mean nothing really gets done by July 4th. I believe President Trump is really pushing. He’s not too pleased by this, but House Republicans, for example, really want that SALT increase (state and local taxes) increased from 10,000 to 40,000. The Senate doesn’t. They have different ideas.

34:27 Laurent Harrison: So, if this fails, the question is, will we see a temporary extension of the Tax Cuts and Jobs Act? Both Ryan and I and the firm believe absolutely, it’s just what will it look like? The other question is, if it fails, will the Democrats get involved in a revised bill? And the reason we say “get involved” is that today, no Democrat, not a single Democrat in either house has voted for either version. So, a lot of challenges going back and forth and it certainly remains to be seen what will get done, but we think it will get done.

Slide 18: “The Big, Beautiful Bill” – Review & Update Cont’d

35:01 Laurent Harrison: Another kind of facet to this is that there’s quite a few Republicans that did not want to add to our debt at the moment, given how high it’s become over the last two decades. There is an organization in Congress known as the Congressional Budget Office. On the Senate bill, they’re estimating that it’s going to add $2.8 trillion in new debt over the next decade. So that’s not too pleasing to certain Republicans and obviously to the Democrats. However, it is what it is, as we say. We’ll see if that ends up getting passed by both houses or not.

35:43 Laurent Harrison: The credit rating by Moody’s has actually been cut in response to the increase in debt. The fact [is] that this version of the bill is likely going to increase our debt levels. So, there was concern by many experts that this would impact the demand for U.S. debt by sovereign countries overseas, in Asia. However, we’re not seeing those demand fears at the moment. So [it] looks like things are okay, at least at the moment.

36:16 Laurent Harrison: Just a comment about the Senate version of the bill. This is very different from the House version, but they want to cut Medicaid, for example, which is essentially cutting out the reimbursement. Those taxes that they reimburse states from 6% down to 3.5% in states that expanded Medicaid under the Affordable Care Act. So, lots of work to be done on that. And again, we’ll see something, just not sure exactly what that’s gonna look like.

Slide 19: Clients Have Been Asking…

36:49 Laurent Harrison: So we’re gonna go through this fairly quickly, Ryan, if you don’t mind. These are just a few questions that our clients have been asking.

37:01 Laurent Harrison: We’ll start with tariffs. So if tariffs are going to lead to higher inflation, which you talked about, why hasn’t this shown up today?

37:09 Ryan Kelley: I would say the biggest thing is just inventory buildup. There was this rush, as I mentioned, to import products prior to the expected tariffs coming in. So, a lot of inventory came in prior to the tariffs going into place. And since it’s not subject to tax, [there] hasn’t been a need to raise prices, as well as just the fact that a lot of these tariffs are in pause mode, so to speak. They haven’t been fully implemented yet.

37:37 Laurent Harrison: Great, thanks for that update. Number two, international stocks. Besides currencies, which we know has had a positive impact on international stocks this year and a negative one last year, any other reasons that international stocks are doing so well in 2025 year to date?

37:55 Ryan Kelley: Yeah, I’d say besides currencies, it’s not so much that international stocks have had some surge in profits that’s driving their share prices. A lot of it is really just international stocks [were] kind of left for dead. [International stocks] somewhat became an ignored asset class, given the extreme performance with the U.S. market and especially U.S. technology companies.

38:19 Ryan Kelley: And I think a lot of President Trump’s policies have really led people to look abroad once again. [Also,] I mentioned [before] this unwinding effect. I think things just got so stretched, especially post-presidential election at the end of last year. Some of what we’re seeing is really just a blowing off of excess pressure that should never have been built up in the first place.

38:42 Laurent Harrison: Got it. So being diversified, it sounds like is a real boon, at least this year, which is good to see. International stocks, make sure you have some of those in your portfolio, which most clients, that’s our standard portfolio, so most clients do.

38:58 Laurent Harrison: You mentioned tech stocks. We saw some pretty big gyrations in tech stocks earlier this year. They were really the darlings of the markets in the last two years. What are your thoughts about this sector today as we wind down the webinar?

39:17 Ryan Kelley: Yeah, it’s a great question. It’s very difficult to answer. And unfortunately, it’s also very important to portfolio allocation. But at a high level, I’d say most of these mega cap tech companies, generalizing of course, still look really good. The companies themselves look great.

39:37 Ryan Kelley: But unfortunately, you’re also paying a very high price to get that greatness. The open question is, is that high price worth the cost or not? That’s very hard to answer. What I can say at the individual level with some of these companies, if we look at Apple and Google, both of these companies are undergoing a lot of legal scrutiny. [They have] anti-competitive actions and lawsuits against them, as well as there’s also an open question with the rise of artificial intelligence [of] how it’s going to impact these companies as well.

40:15 Ryan Kelley: Specifically with Apple, they’re seen as behind the curve on AI, possibly needing to undergo some expensive acquisition to fix that. And then if we look at Google, there’s a question of, Google’s getting most of the revenue from ads they sell in search. But a lot of that’s those search things just switch queries to some AI chatbot, ChatGPT, or even Google’s own Gemini. Will they have the opportunity to sell as many ads if people are just maintaining their eyeballs within the text-generated responses, as opposed to clicking on some external advertising link where then Google can get money?

40:54 Ryan Kelley: So those are just a few of the examples of things that are impacting some of the larger, well-known U.S. tech stocks. But you could go on to Nvidia’s sales forecast and on and on, and it gets very complicated. Predictions in general, as we know, are difficult. At a high level, it’s hard to give us a solid answer on this question.

41:19 Laurent Harrison: Got it. Well, we do like to ask you tough questions. Good to see, though, that both the U.S. market and tech stocks are back in the positive for the year. That’s a nice start to summer.

Slide 20: Webinar Summary

41:31 Laurent Harrison: We did cover quite a bit [of ground today], everything from U.S. and global events, economic updates, all the way through questions from clients. We really appreciate it if you are hanging out through the end of this webinar.

Slide 21: Questions?

41:50 Laurent Harrison: As we mentioned, if you have any questions, go ahead and submit them in that questions box on your screen. And we’ll go ahead and answer those individually via email. And again, just a note, we have moved from the Oakland office over to Orinda. So for those folks that are in the Orinda and East Bay area, we’re looking forward to seeing you at some point in the future in our new office there. So with that, thank you very much for attending today. We appreciate it. Have a good rest of your week. Thank you.