Global diversification didn’t work in 2014. Recognizable U.S. large-cap names that comprise the headline indices fared well, resulting in the Dow Jones Industrial Average and the S&P 500 posting strong returns of 10.0% and 13.5%, respectively, for the year. Outside the United States, both developed and emerging markets lost money in 2014, with the MSCI EAFE and MSCI Emerging Markets indices declining -4.5% and -1.8%, respectively. Therefore, if you had a properly diversified global equity portfolio, you did not fare nearly as well as the U.S.-based headline indices.

Although geographic diversification didn’t work last year, it can’t be said that it doesn’t work. Diversification is protection against the unknown. Because you do not know what the future will hold, you spread your bets. It is a hedge against the risk that your country’s stock market does nothing (or worse) for an extended period of time.

Japanese equity investors know full well the importance of diversification outside their borders as the Nikkei Equity Index remains at less than half the level of its all-time high set 25 years ago. Investors in the United States should understand as well, as the S&P 500 Index gained just 4.6% in total (including dividends) in the first eleven years of this millennium (0.4% annualized). But that lesson can be easy to forget after a strong six-year bull market in U.S. large-cap stocks.

The best way to think about diversification is as insurance for your portfolio. You carry insurance on your home, on your health, and most likely on your life. You have it for a reason: in case something goes wrong. Just because the insurance doesn’t pay off in any given year doesn’t mean that it no longer makes sense for the long-term.

The Tangible Benefits of Diversification

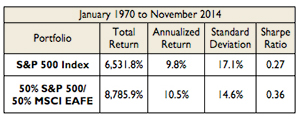

Unlike all other forms of insurance, geographic diversification comes at no cost to you. In fact, it actually pays you. This is because—over the long-term—geographic diversification not only reduces risk, but it also improves returns. From the start of 1970 through November 2014, moving 50% of your S&P 500 Index portfolio to the foreign stocks of the MSCI EAFE Index and rebalancing annually would have increased your overall return by nearly 30% (+0.6% annualized) and reduced the volatility of your portfolio by nearly 15%.

The reason for this is that foreign stocks are influenced by different variables than U.S. stocks. Different economies, demographics, monetary policies, currencies, geopolitical risks, etc. As a result, foreign stocks do not move in lock step with U.S. stocks, and they each often follow their own cycles—both positive and negative. This uncorrelated behavior produces diversification for your portfolio by smoothing out (and enhancing!) returns over time and by providing insurance against something going wrong in the U.S. financial markets.

Geographic Diversification and Momentum Investing

Geographic diversification is an important component of a momentum-based investment strategy. Because of the aforementioned cycles that foreign and domestic stocks go through and the diversification benefits it creates, we look to take advantage of major investment themes and positive trends worldwide. However, the method is different than the one in the example above, in which we illustrated the benefits of geographic diversification via a strategic asset allocation strategy.

Within a momentum strategy, we are looking to be as diversified as possible globally within the context of what is working in the market currently. That means that our foreign stock allocation will vary over time from the market weight of 50%. If the trend favors foreign stocks, more than half of our allocation will be invested abroad like it was in the mid-2000s. If the trend favors U.S. stocks, as it does now, we will have more than half of our allocation invested domestically.

Even though the trend strongly favors U.S. stocks now, we still have some foreign investments in places with positive momentum. It is rare that we are exclusively invested in U.S. stocks or foreign stocks. Even within a strong U.S. trend, there are typically locations outside the U.S. performing well. And even when foreign has a strong lead over the U.S., there are usually segments of the U.S. market that demonstrate positive momentum.

Conclusion

Although you were worse off in 2014 for having diversified your portfolio overseas, we hope you understand the point of geographic diversification as well as its long-term benefits. Despite a tree failing to fall through your roof this year, we presume that you will not be cancelling your homeowner’s insurance. Nor should you cancel your portfolio’s insurance.