On New Year’s Eve, Lake Superior State University released its 38th annual edition of the “List of Words to Be Banished from the Queen’s English for Misuse, Overuse and General Uselessness.” Not surprisingly at the top of the list of twelve is “fiscal cliff,” which received the most nominations. We couldn’t agree more, so let us apologize for not adhering to the ban. But with its resolution now complete, we thought it was necessary to bring up the “fiscal cliff” one last time for some closure. After this article, we promise to be in strict compliance with the decree.

The fiscal cliff deal, passed by Congress on January 1 and officially known as the American Taxpayer Relief Act of 2012, encompasses a wide spectrum of tax laws that cover everything from income tax to estate tax, but for the purposes of this article, we will focus solely on the parts of the new law that affect you as an investor.

What was the fiscal cliff?

In case you were on a remote island or smartly turned off the news for the past year: the fiscal cliff referred to a combination of automatic tax increases and spending cuts that were set to take hold on January 1, 2013. According to the Congressional Budget Office, the spending cuts would have reduced the budget deficit by $600 billion in 2013. That would have been a positive. However, they also said that the spending cuts combined with higher taxes would have likely pushed the U.S. economy into recession. That would not have been good. In short, the combination of large-scale spending cuts and tax increases for everyone at once would have been too much of a shock to our slow-growing economy. Because recessions typically lead to bear markets, “falling off the cliff” would have been negative for risk assets and investors as a whole in the near term.

Averting a recession

With the deal reached by Congress, $109 billion in spending cuts that would have taken effect by now have been delayed for two months, effectively giving Congress more time to figure out the best way to implement them, if they end up implementing them at all. As for taxes, the current income tax rates have been extended for all but individuals who make over $400,000 per year and married couples who make over $450,000 per year. While there is much noise being made about a payroll tax increase for all workers, payroll taxes were set to increase anyway after being temporarily reduced for the last two years, so this increase was not part of the fiscal cliff deal. In the end, the deal averts the sudden shock to the economy that the Congressional Budget Office feared would put us into recession, which is a positive for risk assets and investors in the near term.

Changes to investment taxes

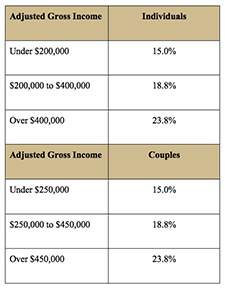

Without any action by Congress, federal capital gains tax rates were scheduled to increase from 15% to 20% in 2013. On top of that, qualified dividends were to revert to being taxed as ordinary income, meaning an increase in the top federal tax rate of 15% to 39.6% in 2013. The fiscal cliff deal addressed both of these issues for investors by increasing the top tax rate on capital gains and dividends to 20% but only for those taxpayers above the $400k/$450k income threshold mentioned above.

While it would be nice to say that if you make less than $400k/$450k in income you will see no increase in investment taxes, unfortunately it is not that straightforward. Included in the Affordable Care Act of 2010 (aka “Obamacare”) was a new 3.8% tax on investment income (i.e. interest, dividends, and capital gains) for individuals who make over $200,000 per year and married couples who make over $250,000 per year. This tax was set to debut in 2013 regardless of how the fiscal cliff negotiations panned out. So with that in mind, federal capital gains and dividend tax rates now look like this:

Investment considerations

In looking at the past, we have found no evidence of a correlation between increasing investment taxes and decreasing stock prices, so the concern that stocks will perform poorly because capital gains and dividends are now being taxed at a higher rate is simply not grounded in precedent. Additionally, only a very small number of taxpayers will see their investment taxes increase as the IRS recently reported that in 2009 just 2.8% of individual income tax returns had an adjusted gross income of at least $200,000.

While the fiscal cliff made headlines and weighed on investors’ minds for most of 2012, the end result suggests that you make no changes to your portfolio as very little has changed. Now what can we worry about in 2013?