Presenters:

- Laurent Harrison, CFP®, Senior Investment Advisor and Financial Planner

- Ryan Kelley, CFA®, Portfolio Manager

The transcript below has been edited for clarity.

Slide 1: 2020 Market Review, Opportunities in 2021, & Tax Tips to Take Now

00:02 Laurent: Hello, and welcome to today’s webinar. Bell Investment Advisors is proud to present to you: 2020 Market Review, Opportunities in 2021 and Tax Tips to Take Now. My name is Laurent Harrison, Senior Investment Advisor and Financial Planner, and I’m joined today by my colleague Ryan Kelley, Chartered Financial Analyst and Portfolio Manager. Welcome Ryan.

00:21 Ryan: Happy to be here.

Slide 2: Webinar Overview

0:22 Laurent: Today we’re going to cover a few topics that we think will be of interest to you, including last year’s market 2020 and what we’re doing in 2021, a bit on interest rates and inflation, and how that’s affecting the economic recovery. Of course, a little bit on the new Biden administration and what’s going on there, and that’ll be covered by Ryan Kelley. I’ll then cover inflation and investment risk in your portfolios, how can your Bell advisor team help you today and tax tips to take now.

0:56 Laurent: But before we begin, I’d just like to remind you that a recording of today’s webinar, along with a transcript, will be posted to our website within 48 hours. The slides are available upon request. Also, if you do have a question, please submit via your questions bar, and we’ll follow up individually with you after the presentation. So with that, I’ll turn it over to Ryan.

Slide 3: 2020-2021 Markets in Review

1:18 Ryan: So to review financial markets, starting from the end of 2019, I’ve picked three different asset classes here. The blue line is the Russell 3000, which is a measure of the overall US stock market. The yellow line is the Bloomberg Barclays US aggregate bond market. And then the orange line is the MSCI All Country World Index X US, so it includes both developed and emerging foreign markets, but not the United States.

1:56 Ryan: To no one’s surprise, what happened at the start of 2020 was we had a small increase, up through about mid February, when it became clear that there was a global pandemic unfolding. Equity markets sold off very fast, very sharp and very fast. If you notice the yellow line (the bond market), there was a slight drop. I’ll talk more about this in further slides but overall since interest rates fell a lot at the same time. You didn’t see much of a decline overall.

2:32 Ryan: And then, not only to have this really sharp sell off (the bottom was late March), we then had a very strong rebound in financial markets as well. The US stock market was back to positive in the summer. Foreign stocks took longer. They got back to breakeven around, I believe it was, November. If you look over the fall timeframe, you’ll see the US stock market has been up about 30% and foreign stocks, maybe about 10 to 12% less than that. US definitely beat international stocks over this timeframe.

3:09 Ryan: Looking at the bond market itself, it looks relatively flat compared to the stock market. If you were to zoom in a little bit, you would see that the bond market was up about a little less than 8%. It peaked actually in August, when interest rates bottomed out. Ever since then, interest rates have been increasing. And when interest rates increase, bond prices decrease. So you can see it’s actually a shallow curve as opposed to a flatline, and you’ll see that there’s been some ground lost for fixed income investors over the past few months, especially this year.

The losses have accelerated over the timeframe listed here, though you’re still up maybe 3.5%, 4% or so.

Slide 4: Bell Equity Changes 2020-2021

3:58 Ryan: So what did we do at Bell during this timeframe? We obviously have a lot of different accounts with different objectives and investment approaches. But just at a real high level, we did trim US large cap growth exposure towards the end of 2020. There was a few ways that took place but overall the goal was to trim back, if not taken outright, underweight on growth, just because those types of mainly tech stocks had done so well. And probably, in our opinion, unjustifiably well until we moved more money into a neutral, or in some cases value type stock, that had been more neglected.

4:45 Ryan: We did do a pretty widespread rebalancing program in October to bring some of the models back in alignment to their risk targets. Those changes are usually more minor at the margin. Within Class 4, or our Balanced Fund category, we did make a few changes. We did reduce risk in a few cases. We swapped certain funds out to pursue a more global investment approach over this timeframe. There was one specific fund that had a growth stock equity bent to it that we got rid of, and we swapped in a different fund to again retrend some of that growth exposure in the portfolio. And of course on that, that also means we’re less US focused to achieve some of this global emphasis.

Slide 5: Bond Changes During 2020

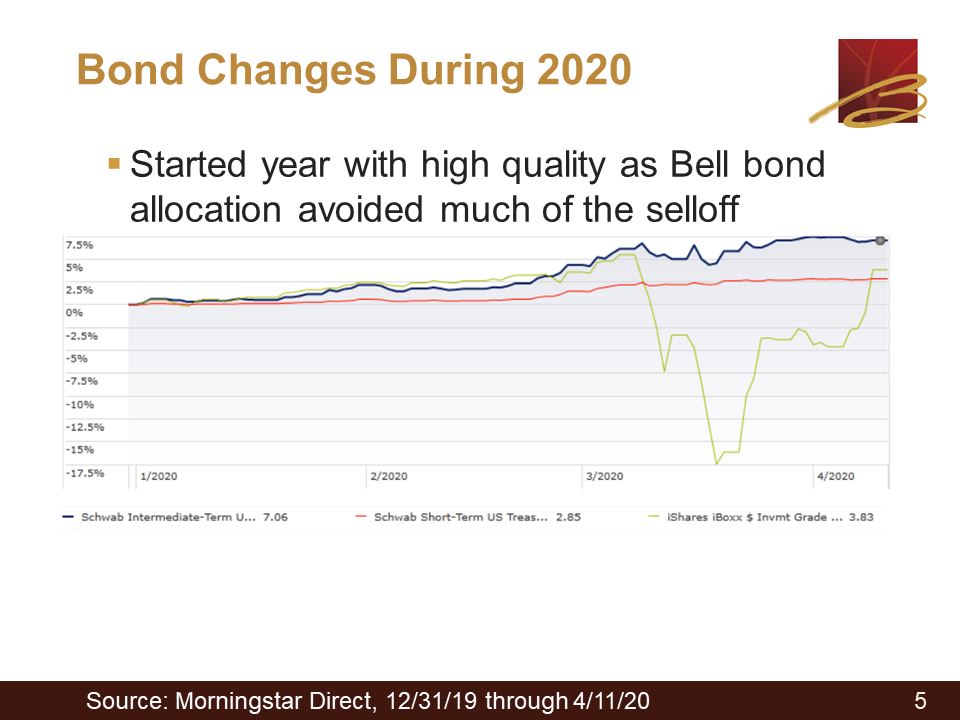

5:40 Ryan: I’ll mention a little bit more about the bond market. If you recall from the two previous slides, there was that little dip in the height of the Coronavirus pandemic during March of 2020. I just wanted to break that down a little further. During this same time period, I’m showing three different ETFs here. The blue line is an intermediate-term Treasury index. The red line is a short- term US Treasury index, and then the yellow line is a Corporate bond index. They’re both ETFs that track an index.

6:21 Ryan: You’ll see something pretty remarkable. The corporate bond actually had a pretty heavy sell off. Peak to trough, you were down 18% or so in the span of a few weeks (actually, two weeks). Meanwhile, the Treasury investments held up very well. What we had done internally at Bell for most of the portfolios is really take a more high quality approach to our fixed income portfolios. So really, avoiding a lot of the corporate bond exposure and favoring government exposure. This was back in late 2019.

6:58 Ryan: The reason we did that was not because we were forecasting a global pandemic would strike. But it was just that at the time, and we actually find ourselves in the same position now, the extra return that corporate bonds paid was pretty meager over treasuries. And so we like the more high quality and relatively safer Treasury or government backed fixed income options versus corporate. That decision worked out really well over this time frame. A lot of volatility was mitigated by taking that course of action.

Slide 6: 2021 Risks: Rising Interest Rates

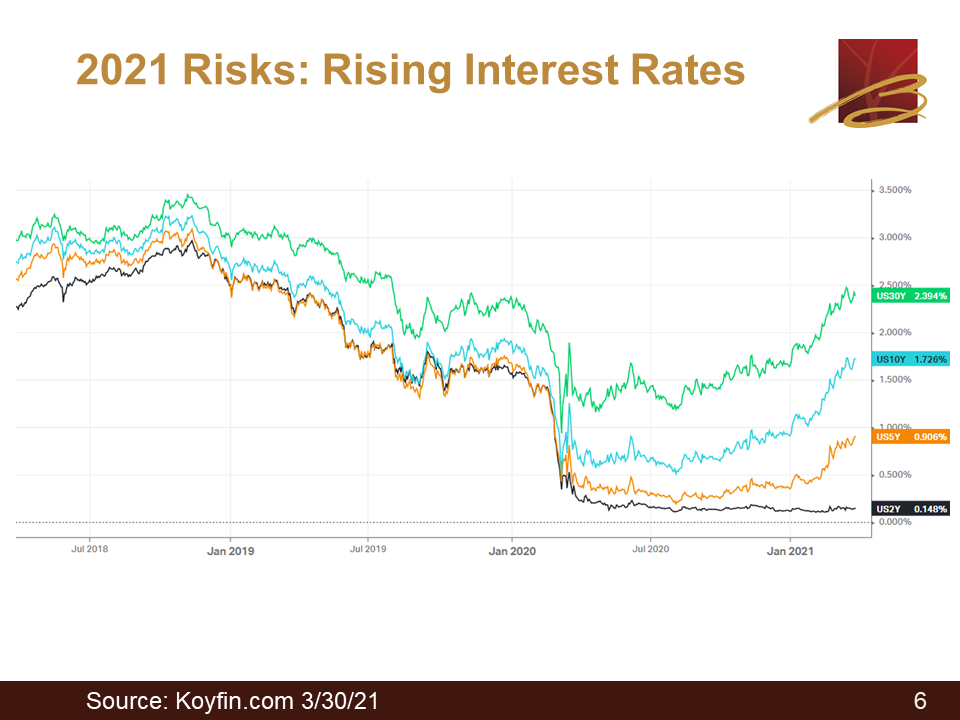

7:36 Ryan: I mentioned that interest rates have been going up and that’s been affecting the overall bond market. You can see here, these are just different interest rates paid on different maturity US Treasuries. The black line is a two-year, orange is a five-year, and blue is ten, and in green is thirty. You’ll notice one thing that’s particular. I’ll point out two things actually.

8:05 Ryan: So the first thing I’d point out is rates have been going up, but that depends on your maturity. You’ll notice the biggest increases have been in the longer maturities. Meanwhile, the two year’s have been flat. The reason is, on the shorter end of things, it’s really tied to Fed policy. The Federal Reserve has indicated they’re going to wait a long time to raise rates. Therefore, the short term maturities don’t really increase much but the longer term securities are more driven by market mechanics. You’ve seen a pretty healthy rebound in interest rates. I point out that, even though they have rebounded quite fast in not just over this time period but really starting this year, there’s been a pretty big exceleration in rate increases. If you just go back previously, you’ll see that we’re still well below where we were, even at the start of 2019. So rates are still unbelievably low, and lower than they have been for most of recent history (if you exclude last year).

9:17 Ryan: The other thing I’d point out is that it makes sense rates should go up. If the stock market is supposedly going up because there’s an economic recovery in place, then one thing we wrote about is why haven’t rates gone up (long term rates)? I guess the market’s finally coming around to our point of view, and you’ve seen quite a big increase in interest rates. But again where levels are right now is still extremely low, even to where they were back in 2019.

Slide 7: 2021 Rising Rate Impact not Equal

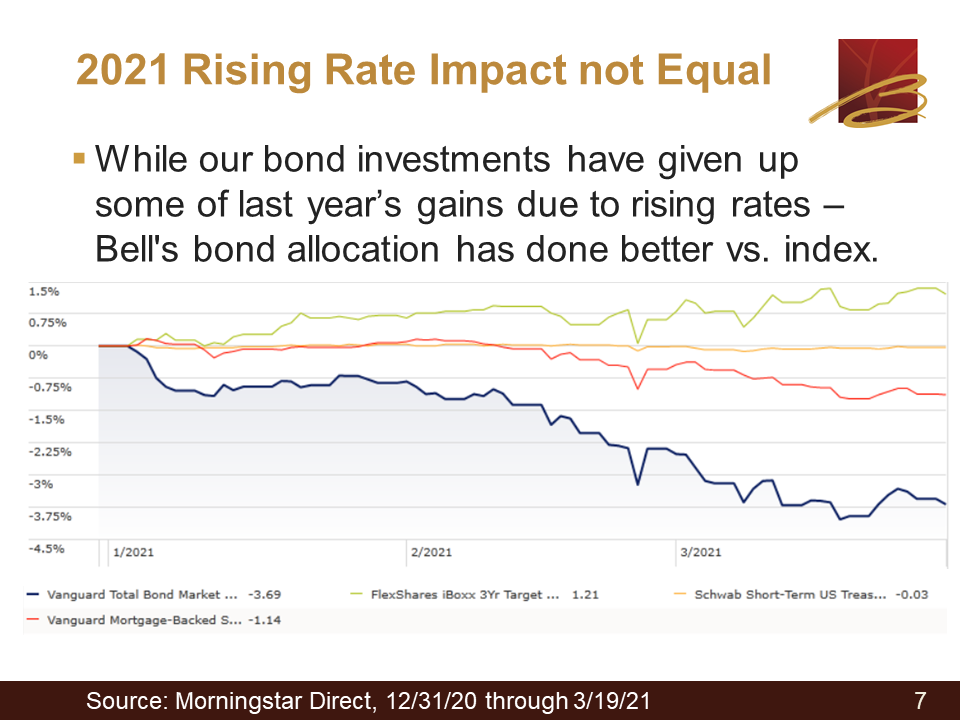

9:47 Ryan: I would point out that because of this, we’ve also positioned ourselves with a fixed income portfolio that is really short, and you can see why from this graph. So again, the blue line is the overall US bond market, using ETFs as a proxy for the benchmarks, but these are all passively tracking benchmark fixed income options. And so you’ll see that year to date, there’s been an erosion in the overall bond market and value. Not quite at 4% but getting there. Meanwhile, the way we’ve positioned our portfolios, as I mentioned, high quality but also short, to avoid some of this erosion as rates have started to recover.

10:28 Ryan: We just felt that rates didn’t look attractive even pre-pandemic, and they fell so low it just didn’t make sense to hold a 10 year bond in my opinion, especially when it was paying almost just half a percent at one point in time last year. A lot of the gains that have longer maturity securities had earned last year, they just keep eroding. Meanwhile, the shorter term stuff is mostly flat.

10:58 Ryan: So if you have a more conservative portfolio at Bell, you may see it’s not doing very much, but actually on a relative basis, that’s actually doing pretty great because the relative alternative that you might pick for fixed income is actually lost almost 4% so far this year. And you’ll notice that the best performer of these is actually TIPS. That’s Treasury Inflation Protected Securities. We’ve held a decent chunk of that and added to it in the summer, I believe of last year. And that’s been one of the strongest performers of all the different fixed income options that we look at so that shift worked out very well for our clients.

Slide 8: 2021 Interest Rates & Stock Prices

11:40 Ryan: So, if the topic is interest rates increasing, equity investors may ask, “well what does that mean for my stocks?” There’s a few theoretical arguments to that. My personal opinion is that what’s happening right now is that we’re getting an economic recovery, which looks very favorable to stocks, but we’re also getting interest rates going up, which in theory makes stocks worth less. You have a higher discount factor going on which makes their future earnings worth less today.

12:16 Ryan: All that has to balance out also when we have higher valuations. So we’ve started this year with extremely high multiples on our stocks. If you consider $1 of earnings, the multiple is how much you going to pay for that same dollar of earnings. We started at a very high level. We started at extremely low interest rates.

12:40 Ryan: Interest rates are punishing or pushing down multiples as they rise, but at the same time the economic recovery looks actually pretty healthy. And that’s creating this push-pull effect. At first it had been making the market pretty choppy. Since then, especially during March, we’ve broken out and hit new highs. It’ll remain to be seen how long that can stay in place should rates continue to rise. I think there’ll be more headwinds to further equity gains if that does happen.

13:19 Ryan: But one of the main concerns of equity investors right now is actually losing the Federal Reserve support that implemented a lot of policies during the Coronavirus pandemic to prop up the economy, which also was very favorable for equity investors. So of course those policies that support stock prices could be taken away. That is a risk. The Fed has signaled that they’re willing to delay raising rates, on the shorter end at least, for quite a while longer than they normally would.

13:52 Ryan: There’s always a risk that, if inflation returned, it would force their hand, probably having to raise earlier than they would otherwise, with sliders of risk or just general loss with the Fed, changing it’s mind or for whatever reason, raising interest rates or removing some of the supportive policies to financial markets.

14:16 Ryan: I will point out that since the bottom of last year in March of the stock market, we have yet to see a 10% correction in stocks. I would guess that when I looked at this, I think the biggest correction may have approached 8% or so, but typically you just expect 10% or greater correction every single year, and we haven’t seen one for over a year. So every time you might see some volatility, if you really take into full consideration, there actually hasn’t been much volatility at all. It’s almost gone straight up since March of last year.

Slide 9: Inflation Concerns and Impact

14:59 Ryan: I mentioned inflation as a possible source of pushing the Fed to raise rates. That is a concern. The Fed has actually made a policy change. In the past what they would do is, when they were going to raise rates coming out of economic trough and into an expansion at some point they would raise rates. They had this 2% target that they would try to hit. Say inflation hit 2% They would start raising rates to not go above their inflation target. What they’ve said now, which is a change from the past, is that they’re willing to wait and let inflation run hot to make up for past under inflation. So you can imagine if we had inflation at 1%, and it was supposed to be 2, the Fed’s going to let it get to 2.5, 3% for a while to make up for that underperformance of inflation, which is a new policy. What may happen is, if they do follow that approach, when they finally do raise, they may raise a lot quicker than they otherwise would have because inflation is sort of like letting the horse out of the barn, so to speak.

16:13 And so they’re a bit nervous if they do let it run hot. I wouldn’t be surprised to see them raise a lot quicker than they otherwise would to make sure things didn’t run away from themselves. And finally one point I’ll mention on inflation. If you consider inflation on a year over year basis, these next two monthly numbers that come out are probably going to be on the higher end of things. The reason is when you’re measuring back as your denominator a year, there’s two months we had last year (April and May) where prices actually went down due to the pandemic. And so since you’re measuring from a lower base (a smaller denominator) even if the month over month rate hasn’t really changed with inflation, you will see a year over year acceleration in that rate. I just point out that that’s a statistical anomaly and doesn’t necessarily mean that inflation is accelerating a lot.

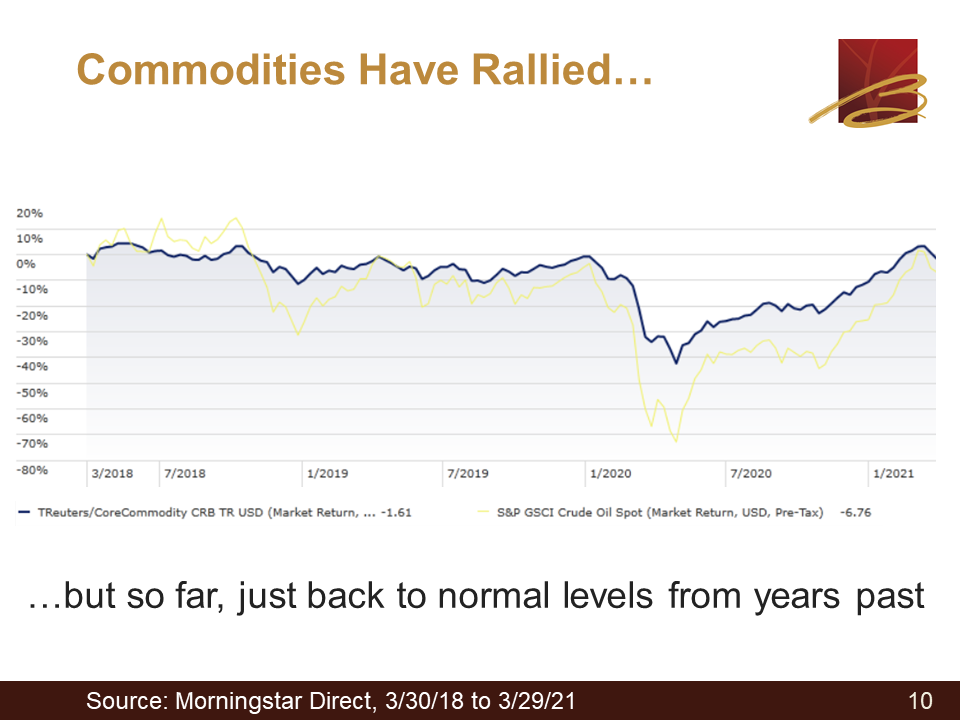

Slide 10: Commodities Have Rallied…

17:15 Ryan: One other measure on the subject of inflation. Commodities have rallied quite a bit since the lows that we saw in March of last year. As you can see from the chart, we’ve really just gotten back to where we’ve been in previous years. The yellow line is the spot price of oil, and the blue line is a commodities amalgamation that has different industrial metals like copper. It has agriculture, wheat, oil, natural gas, etc. It’s a diversified commodities benchmark, but you could see whether using the diversified benchmark or the just plain oil spot price, that yes we’ve had a pretty (in percent terms from the bottom) strong acceleration in commodity price gains. But where we’re at right now, just zooming out a few years, doesn’t look like we’re in some worrying spot for the time being.

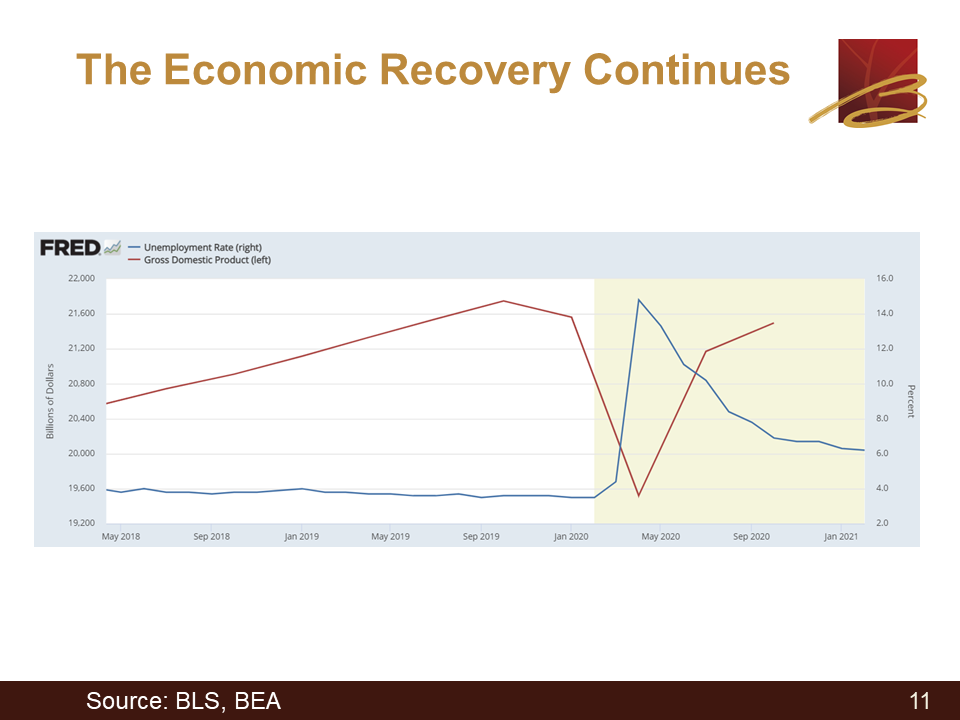

Slide 11: The Economic Recovery Continues

18:20 Ryan: A lot of these price increases are based off the economic recovery that I mentioned, looking stronger and stronger. I have just two high level data sets here. The red line is GDP. That comes out on a quarterly basis, so it’s a little choppy, a little low resolution if you will, but you can see that even at the last data point we were pretty close to getting back to where the all-time high was pre-pandemic. It would not surprise me to see the next data point for the end of the first quarter to get us there or get us pretty close. And then the next quarter would make us probably eclipse and hit new all time highs. The consensus growth estimate for GDP this year is, last time I checked, was 6 to 7%. There’s a few banks that are saying higher and lower as always, but 6 to 7% is probably a good guess right now for what the economy will grow during 2021.

19:25 Ryan: You can see though that, even if we do hit new all time highs this year (which looks likely) the blue line is unemployment. While it certainly has recovered a lot from its worst level during the pandemic, you can see there’s still quite a lot more progress that would need to be made on unemployment to get us back to the lows that we had before Coronavirus came. That recovery in the labor markets will probably take quite a bit more time than that just overall GDP level hitting new all time highs.

Slide 12: A New Administration

20:00 Ryan: Tied to a lot of this is the new administration, some of their fiscal packages, stimulus and infrastructure. We did get the $1.9 trillion stimulus that got passed in the Biden administration. There have been (on the tax front changes) a few things proposed. I won’t go into them and these are not necessarily proposed by the administration, just various members of Congress. Wealth tax has been proposed. President Biden’s latest infrastructure plan actually includes a corporate tax rate increase from 21 to 28%, so a 7% increase. But that’s still lower than the tax rate we had for decades, pre-Trump’s cut that he did in 2018. So previously, we were at 35% for quite a long time. This is going back partly to where we were, but it’s not a full corporate tax increase back to where we were, say in the 90’s.

21:17 Ryan: I’d also point out that the effective rate that’s paid by corporations, even if that’s the official tax rate they pay, when you consider deductions and things like that, it’s actually quite a bit less in percent of net income terms, which is actually paid out in federal income tax. But besides a corporate tax increase, which has now been proposed as part of this infrastructure plan, there’s plans to get rid of favorable long term capital gains rates for wealthy households. There’s proposals to get rid of appreciated asset on inheritance tax transfers so you would no longer get the step-up basis.

21:57 Ryan: The way it works right now is that if someone has property they purchased 50 years ago and they just hang on to it until they pass away, the heirs never pay any capital gains on that. They just take the final value and look at the estate tax based off that. The idea would be to get rid of that. I’ve even heard proposals of not even having a capital gains tax and you’d simply be taxed every single year based off the appreciated values, whether you sold or not. All these various policies have been proposed but besides the corporate tax change, which is part of this plan, the other ones just remain. One Congress person may have proposed it but that may be the extent of it and we never hear anything again on that subject.

22:42 Ryan: As far as the infrastructure plan that just got announced on the 31st of March, it’s still pretty new. The total is a bit over $2 trillion or so. But remember, it’s just a proposal. What actually happens, if anything, will likely be pared down. It includes a lot of things which are infrastructure. Expect roads, bridges, money for ports, etc. It has other things which are infrastructure but maybe not what you’d think, for example, high speed internet broadband availability, proposals for funding for electric vehicle chargers, as well as things that probably wouldn’t be defined as infrastructure by a lot of people.

23:31 Ryan: For example, there was one on energy efficient upgrades for houses, and few other things, which are maybe not as related to infrastructure. This proposal will be debated, and we’ll see if it gets passed. I would point out that both Presidents Obama and Trump also wanted to push through pretty ambitious infrastructure upgrade package and neither one was able to get it approved and signed. So we’ll have to wait and see what the probability is something will get passed here.

24:11 Ryan: I did want to point out one final thing though on this subject. There’s been some questions from clients, rightly recognizing that the new administration is more favorable towards green energy and things like that. Now we have this infrastructure bill proposed. Just because Congress may act on something, and you may see spending, it doesn’t necessarily mean it’s a good place that you want to invest your money. I’d also point out that a lot of these areas have been extremely popular and hyped up over the last year or so. The volatility level, in some of these themes that you might want to invest in, like green energy for example, is extremely high. There’s a NASDAQ Green Energy ETF, and it’s done extremely well in the last year or so.

25:11 Ryan: But the problem is it’s extremely volatile as well. I checked. If you had bought in on February 9th of this year, in one month’s time you would have lost about 30% of your money. I would just caution clients that oftentimes it’s harder to have a good investment plan based off some high level theme that you may read about or or some law that’s proposed that in theory may benefit some certain sector. It’s very difficult to take advantage of these types of ideas. Oftentimes, especially now, they’re also pretty risky from a volatility perspective because there’s so much enthusiasm in these areas.

Slide 13: Thinking about a change in risk?

26:01 Ryan: So with that, let me turn things over to Laurent. He will discuss some changes to how you want to manage your portfolios and how you want to think about risk.

26:12 Laurent: Great. Thanks, Ryan. Really appreciate that. So, quick summary. Ryan’s talked about 2021, took a look at inflation, high value of stock prices, some of the risks involved and obviously what’s going on with the bond market, as well as a bit on the Biden administration. Just a summary or review if you’re thinking about a change in your portfolio investments or change in risk. The good thing is you have an opportunity to reassess risk levels if you were at all feeling uncomfortable last year. However, I will make a point, the folks that really stayed the course last year, both in the ups and downs of the market, are generally the ones that perform the best, or at least perform to the level of their expectation in terms of their investment strategy. However, it’s always appropriate to change your risk level when things are good, rather than when things are headed down in either the stock or the bond market.

27:16 Laurent: So if this is something you’re thinking about and you were feeling at all uncomfortable last year, is a great time to ask for a risk review with your Bell advisor and service team. We do have a number of new tools to do a risk profile analysis. We’re always looking for new tools, new research to help our clients out there. Now it’s important to remember that if you’re making a change in investment risks to a taxable account, we have to take into account the tax impact. Generally, if you’ve been in stocks, you’re probably going to have a gain. Obviously with bonds, not as much of a gain. Those are things to take into account when thinking about making changes. If you’re also in retirement distribution mode, and taking retirement distributions, those are certainly something to think about when you’re changing risk. We always say on a taxable account you know you always have to think about the tax impact, maybe taking a little bit less risk in taxable accounts if you need that cash anytime soon. Cash flows are also considered, and we’ll help you with all of that as your advisor team.

28:29 Laurent: And then the last couple of steps is we always recommend you consider your emergency reserves and bond reserves because that really helps through the downturns that we experience from time to time. And then lastly, we do have a new Bell Investment Objectives Form for folks to sign. When you get ready to make those changes, we’ll be sending that out to you. Again, thinking about change in risk? Now’s a good time to do it before the next correction or downturn in either stocks or bonds.

Slide 14: Investment Strategies Today

29:03 Laurent: So if you have at all taken a look at the new Bell website recently, (we went live in mid February) you’ll see a very streamlined version of it. Access to the Bell portal, which is where you can get your electronic statements now every month versus having them mailed out. It’s been in place since the pandemic started in the shelter in place, well over a year ago. And we also have a number of different investment strategies, and again this is very high level. We’re not going to go into detail here, but for those of you who have been with Bell for many years, you are used to the momentum based approach. That is now something we call Factor-Based. Momentum is one of the factors in our Factor-Based, more active approach. We also introduced in 2012-2013 Indexed strategies for clients that were interested in being a little bit more low cost, indexed approach. We’ve got a number of clients these days that actually have access to both. Some have some Indexed and some Factor-Based investments.

30:14 Laurent: Then we also have a more conservative active approach called Bell Stable Growth. It’s been very popular with retirees and with those looking for a little bit more defensive, less aggressive, growth in their portfolios. Lastly, we’ve always had a bit of a Social Impact approach to one or two of our strategies. In the last 2, 3, 4 years we’ve actually augmented that with a relationship with a company called Just Invest, so we have some social impact, or values- based, approaches there. Please ask your advisor team about some of these other strategies if something looks interesting to you.

Slide 15: Managing Risk in Today’s Market

30:55 Laurent: As Ryan mentioned earlier, we are managing risk in today’s market with a number of changes. We made a few changes last year as well as this year in terms of the bonds, as well as globally where we’re invested, whether it’s US based or a little bit more global. We’ve done some rebalancing of portfolios, both on the active side where we trimmed growth exposure a bit back in late 2020. Whenever we purchase one fund and maybe sell another we obviously meet monthly during our investment committee meetings to do that to active based portfolios, we’re essentially doing some of that rebalancing all the time.

31:41 Laurent: And especially if you’re wondering, when do you rebalance? Generally you want to rebalance an account or portfolio when components of that portfolio have grown much faster than others. We don’t want it to get overly invested in areas that are growing faster. We want to try to reduce that and keep the risk level at about the same level. Ryan mentioned a couple of the late 2020, early 2021 moves, in terms of going global, selling some of our growth, and then getting a little bit more into value and small cap. So those are some of the themes and managing risk in today’s market.

Slide 16: Managing Rising Inflation

32:25 Laurent: In terms of rising inflation, you may be wondering if you have some investments outside of Bell and you’re trying to match what the Bell team has been doing. These are a couple of the themes that we’ve done over the past year: investing in shorter term and higher quality, expecting a bit more volatility in stocks. I think one of the best rules that we’ve seen work really well is definitely keeping some of those emergency reserves or excess cash on hand. It really helps you in those smaller market corrections, as well as the bigger market corrections, to have that cash and/or bonds on hand.

33:07 Laurent: So a couple of themes or questions that we’ve gotten from clients over the past few months, with all of the interest in cryptocurrencies. What is Bell’s position on it today? Well, we’re certainly not recommending it for our clients. It’s considered (even for the more aggressive clients) we consider it to be too much of a speculative investment today. Even though it’s been around since 2008 or 2009, it’s still really (in our view) in the early stages of growth and could easily fluctuate. We saw that in late 2018, 2019. I think it went from $20,000 all the way back down to $4,000 per coin. Now, it obviously jumped from $4,000 a coin all the way up to $50,000 per coin. So again, it’s not the kind of environment, even with inflation, that we are necessarily going to recommend.

34:00 Laurent: One area that we have invested in the past, we have invested in gold at times in our more aggressive accounts and clients that have more of an aggressive approach. What about using gold today? Traditionally, it’s been a hedge against inflation. What do we feel about that today? Well gold can essentially move differently based on the kind of inflation that we’re seeing. And right now, gold is actually down about 15% this year. It was up 25% last year. So traditionally, even though it may have been a hedge against inflation, right now it’s actually not doing nearly as well. That has to do with the fact that interest rises are not all the same with gold and right now gold does not currently like the current inflationary increase, which is going on as a result of anticipated economic recovery. Whenever you see a strong potential economic recovery, gold is potentially not going to do well in that environment. Gold does better in an environment where the economic recovery is not doing so well but the Federal Reserve is maybe raising interest rates for whatever reason. We’re not necessarily recommending gold today as a hedge against inflation.

Slide 17: Helping Clients This Year

35:16 Laurent: A couple of the areas that we’ve helped clients in this past year and in this current year. As we’ve mentioned the new website that we launched recently. If you haven’t accessed your electronic Bell statements and you’re wondering how do I get access to those, just let us know. We’ll give you your own ID and password. You’ll also actually see that in the Bell portal we have a number of new reports and statements that you may not get or may not have had access to in the past, so take a look at that. The other thing is that if we do have presentation slides during a review and you’ll see that towards the bottom. We’re obviously doing client portfolio reviews and plan updates. We’re starting as a best practice to put those actually also on the portal, the Bell portal access.

36:06 A lot of times you’ll be able to find an older portfolio review report, or even the previous financial plan that you’ve worked on and you’ve had Bell update. That’s going to be on the Bell portal access. Use that as a tool. I talked about an updated Investment Objective Forms. The updated risk profile review tools. The latest change is that we are starting to use Zoom for video meetings. We had GoTo Meeting. We had Ring Central. We had a number of other video chat software before. We’ve decided to consolidate onto Zoom for the benefit of our clients, so that should be an improvement for you.

36:50 Laurent: Because we’ve all been working from home for a year, there’s various security additions that you can do when you’re working from home. We’ve improved that quite a bit, using two factor authentication here in 2020. So we’re even more secure today, even though we’re working from home, than we’ve ever been before. Those are some areas that we’re helping clients out.

Slide 18: Tax Tip to Remember

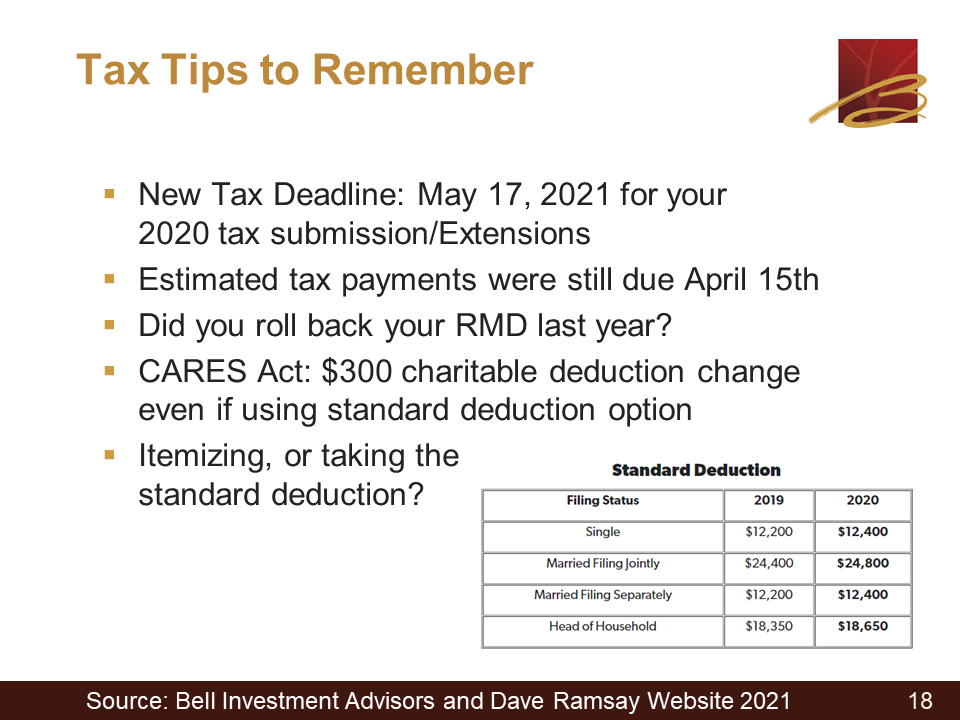

37:12 Laurent: And now actually I was going to move to a few different slides. I know that we’re kind of heading into the end of this webinar and thank you again for staying with me if you’re still here. Here’s a few slides, both for those submitting their taxes. The first news and change is that the new tax deadline has been extended to May 17. Also, if you happen to roll back in RMD last year, that’s something to keep an eye on to take a look at. The CARES Act (that got passed last year) does allow for a $300 charitable deduction, even if you’re taking the standard deduction. That was a big change. In the past the Trump administration increased the standard deduction quite a bit from where it was, and that caused a lot of folks to start taking the standard deduction versus itemizing.

38:07 Laurent: And if you’re wondering where those numbers lie, you’ll see a chart at the bottom here. Depending on your filing status where things were in 2019, and you can see that they’ve gone up just a little bit for 2020. So take a look at that and just remember, if you are taking the standard deduction, The CARES Act does allow you to do, in addition to that, a $300 charitable deduction, even if you’re taking the standard deduction. That’s something that you weren’t allowed to do prior to 2020.

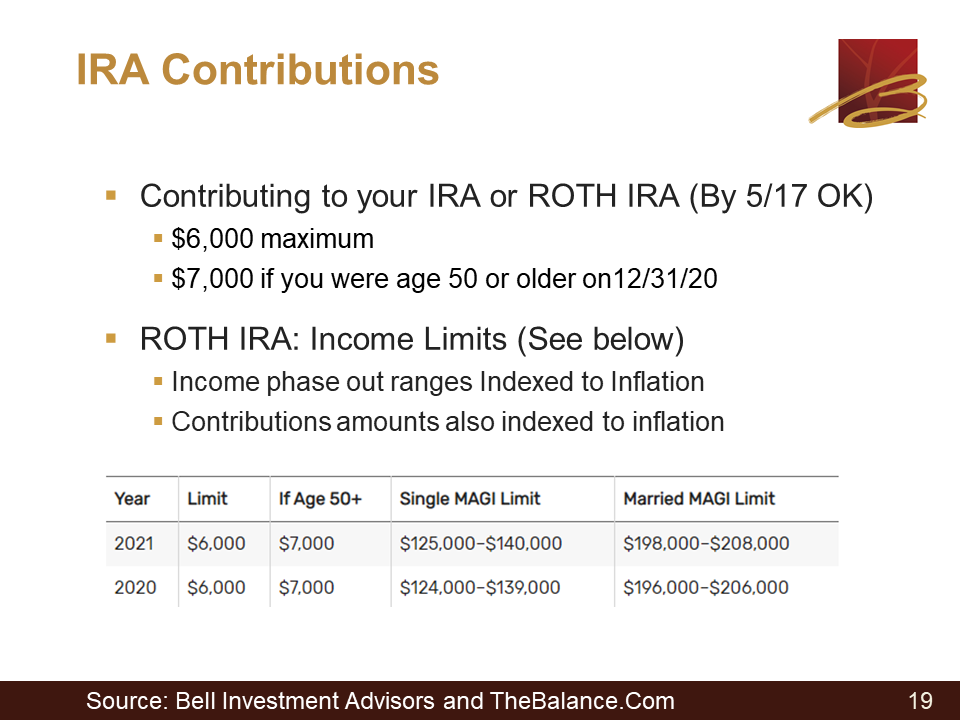

Slide 19: IRA Contributions

38:38 Laurent: The next slide actually has to do with contributing to either an IRA or a Roth IRA. You can see the maximums, whether you’re under the age 50 or 50 or older. And then if you are thinking of doing a contribution to a Roth IRA, there are still income limits. You’ll see below there that if you are either single or married, you have phase outs. Those phase outs in 2020 went basically from about 124 to 139 if you’re single, 196 to 206 if you’re married, and you can see that they’ve gone up a little bit due to the inflation for 2021.

Slide 20: Information Regarding RMDs

39:21 Laurent: And then last but not least, information regarding RMDs, or required minimum distributions. Big changes actually are due to the Secure Act. Previously, if you had not yet taken an RMD and generally that was at age 70 and a half or older, and if your birthday was on July 1, 2019 and you did essentially turn 70 and a half, then you’ve lucked out because now the new age rule is actually age 72. So for all those who had not been taken in RMD and are able to essentially qualify for this, basically higher age or older age of 72, you can now basically plan for that whenever you turn 72 instead of 70 and a half. There is a new rule also for those folks that are still working and have earned income. In the previous legislation, you weren’t able to contribute to your IRA past age 70 and a half. That is no longer true. You can still now contribute to an IRA, even if you’re past the age of 70 and a half.

Slide 21: Conclusions and Summary

40:27 Laurent: I am actually going to change and allow Ryan to come back on and hit the conclusions and summary, and any questions that may come up. Go ahead, Ryan.

40:39 Ryan: Thanks Laurent. In conclusion, markets were incredibly volatile last year, but clients who stayed the course generally achieved the best results. As we saw, there’s been some pretty healthy gains earned since the end of 2019. Given that we’re at all time highs right now, if you would like to reduce your risk profile, now would be a (not that we can predict the future) but when you’re at all time highs, that’s a pretty good time to dial the risk down if it makes sense.

41:14 Ryan: We did launch a new website, as well some risk profiling tools, and more ways to help you achieve your results. Be sure to check them out. And then finally, the tax deadlines were extended to May 17, so be sure that you get everything done but you do have some breathing room this year.

Slide 22: Have Questions?

41:40 Laurent: As we wind down here. Again, if you have questions please go ahead and submit them, and we will go ahead and answer them after the webinar is complete.

Slide 23: Recent Webinars:

41:55 Laurent: And then again, recent webinars is a quick list here. You can take a look and see what we’ve done and what we’ve talked about in the past. You can also go back and relisten to them if there’s an interesting subject.

Slide 24: Stay in Touch!

42:13 Laurent: We hope that you stay in touch with us. There’s a number of resources I mentioned, the new Bell website, you can always email us or the service team, or give us a call. We hope you’re doing really well, staying safe, and getting all of your vaccines done. And just as a last reminder, today’s presentation slides are available upon request and we’d be happy to send those to you. Take care, and hope to see you soon.