Webinar: Economic Recovery – When will it begin? What shape will it take?

As we have helped our clients navigate the financial impact of the COVID-19 crisis, certain questions have consistently risen to the surface of our conversations: How does Bell view the current market environment? When will a sustained recovery start and how might it look? In this Investment Committee webinar, President Forrest Bell, Senior Investment Advisor Laurent Harrison, and Portfolio Manager Ryan Kelley addressed these questions.

This webinar includes:

– An introduction by President Forrest Bell, CFP®

– Recapping 2020’s Volatility

– Where We Stand Now

– V-, L-, or U-Shaped? Three Possible Market Recovery Scenarios

– What to Do in Volatile Financial Markets

– Portfolio Risk – How much is too much?

Presenters:

- Forrest Bell, CFP®, President and Senior Investment Advisor

- Laurent Harrison, CFP®, Senior Investment Advisor

- Ryan Kelley, CFA®, Portfolio Manager

Webinar Transcript [edited for clarity]:

Forrest: Hi! I’m Forrest, President and Senior Investment Advisor of Bell Investment Advisors. I want to welcome you today to this webinar presentation, “Economic Recovery: When Will It Begin, and What Shape Will It Take?” You should see a chat box on your screen which you can use to enter questions throughout this webinar and we will answer them after the webinar completes. If you’d like a PDF copy of any of today’s slides we would be happy to help you with that.

0:41 Before handing this over to today’s presenter, I wanted to make some opening remarks. Every year, each of us at the firm leans on our firm’s core values. That is especially the case this year. And when I think about our core values, the ones that come right to mind for this year are innovate and be kind.

1:05 We are so fortunate to have the technology set up that allows us to work remotely. That blessing is not lost on us. And, we have had to change the way we do things to stay present with clients. You may have noticed that this webinar is different than webinars we have done in the past. It’s amazing to think that as recently as mid-March we were working from our offices. This webinar, however, comes to you from our homes.

1:37 Normally at this time, we would be meeting in person with clients to update their financial plans. We can’t do that right now, so we’re using screen sharing technology. Investment advisors and relationship managers also cannot meet with clients in person, but it has never been easier to reach people at home. We’ve been using phone calls and virtual meetings to continue staying present with our clients.

2:06 Finally, since we’re not in the office right now, we are not able to produce any client statements. However, our newly designed client portal has been a wonderful resource in that regard. There, clients have been able to receive their monthly client letters, monthly statements, and also up-to-date accounting information.

2:29 Be kind has also been a crucial value to us this year. We’ve been so heartened to learn as we’ve reached out to clients that they are taking due precautions and staying safe from this virus. However, we do have small business owner clients who have seen their businesses interrupted this year and some clients who have lost their jobs. It is so important for us to stay in constant contact with them and support them in the ways that they need. We’ve been updating their financial plans to understand exactly where they are and mapping out contingency scenarios that will be helpful to them as this year unfolds.

3:12 I’m proud to have core values that we as a firm can lean on. I want every client to know that they can lean on those values too.

With that, I do want to introduce today’s presenters. Presenting today are my colleague and portfolio manager, Ryan Kelly, joined by Senior Investment Advisor and Financial Planner Laurent Harrison. I want to thank both of you for presenting today. Gentlemen, take it away.

3:47 Ryan: Thank you, Forrest!

Laurent: Thanks, Forrest. Glad to be here today. As we get started on the webinar topics, Ryan’s going to cover the first two, number two and three. I’m going to go ahead and cover number four and five in the latter half of the webinar. Ryan, why don’t you get us started?

4:04 Ryan: Great, thank you. I think it would be good to recap where financial markets and

specifically equity markets have gone a year to date. We started off the year on a positive note, then obviously the coronavirus negative news came out. We saw some really severe downside volatility, and then as of March 23rd, we hit a year to date bottom.

4:32 We saw a pretty rapid recovery, so you can see by the dark blue line (which is represented by the Russell 3000, it’s a pretty good measure of the overall US stock market) that it has been the best performer out of the other stock market or equity types that I have graphed here. If you look at the Russell 2000, which is a subset of the Russell 3000, and it just counts domestic US small cap stocks. You can see that they’ve declined actually more than double what the overall stock market has done. These charts are as of the close of May 14th.

5:10 The Russell 3000 or overall US stock market was down about 12% and the Russell 2000 small cap stocks were down about 25%, so quite a big difference. Looking at a measure of international developed stock markets (that would be the MSCI EAFE II index) you can see it’s down about 21%. Emerging market stocks as represented by the MSCI EM index down almost 19%. Again, this is a trend that has been going on for years where the US overall market, dominated by large cap names, has dramatically outperformed most other traditional equity types that US investors would consider investing in.

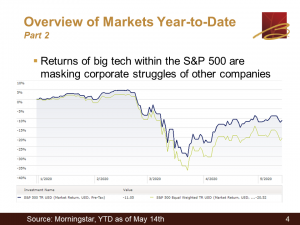

5:55 On the next slide, we will see that another way to measure the market overall is the traditional S&P 500 index. I’m sure we’re all aware that these are the largest publicly traded stocks. The 500 largest stocks in the US stock market. What’s interesting is you can see this disparity between an alternative version of the S&P 500. The traditional version we’re familiar with assigns larger weights to larger companies, as we’d expect. But what’s happened in the last several years is that these large internet names or technology names (Microsoft, Apple, Amazon, Google, Facebook) have become a larger and larger percent weight in the S&P 500 or the US stock market overall.

6:47 Right now, these top five names are actually 21% or so of the benchmark. This alternative version of the S&P actually ignores the size of companies and just says if you qualify to be in the S&P 500 we’re going to give each company an equal weight (1/500th of a weight exposure).

You can see again quite a big difference. While the S&P 500, the traditional version, down 11% year-to-date, this equal weighted version is down over 20%. That’s just the difference between removing the outsize weight that a lot of these large tech giants have in the benchmark and reducing their impact.

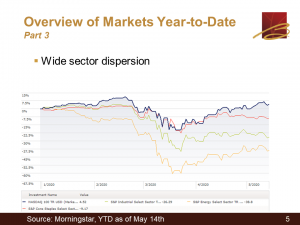

7:31 You can see there’s a different story under the surface, where the average stock hasn’t done nearly as well. On the following slide, we can see this idea in more clarity. The dark blue line is the Nasdaq 100 index. I’m not graphing the technology sector and the reason is certain companies (Amazon for example) are not officially in the technology sector. They’re in that company’s consumer discretionary but the Nasdaq 100 is a pretty good proxy for tech (what we would consider to be tech overall).

8:09 Again, it’s actually up year-to-date, which is pretty spectacular if you think about what’s happened. What I would consider to be the best sector overall for holding up in periods of negative market volatility would be consumer staples, which is the red line. While it has done very well relative to some other sectors, you can see it’s still down about 9%.

8:35 If we then measure that against some other sectors which haven’t done nearly as well, like the S&P industrial select sector is down over 25% and the S&P energy sector is down almost 40%. There’s a huge disparity again between what’s happening in the overall market because of this tech sector effect and what you see in certain other areas of the market. That is a pretty interesting point and something to keep in mind when you think about the disparity between what you’re seeing in the stock market and what you’re seeing in the economy. This does help to explain some of that difference.

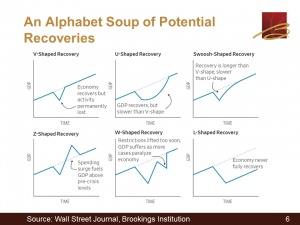

9:19 Now turning our attention to the next slide. Economic recoveries: this will probably be the biggest thing to watch for and what will ultimately shape the direction of the market in the following months and potentially even years to come. That’s how do we recover once we find a bottom and potentially we’ve hit it, but we don’t know? Once we’ve hit an economic bottom from this coronavirus-caused economic decline, what does recovery look like?

9:55 There’s various theories like people like to assign letters or symbols to these as a shorthand for what kind of economic recovery path they’re considering. You can see there’s six here, but I’ve heard there are other ones. I’ve heard of square roots and check marks you can see there’s a swoosh. But in the following slides, I will be covering the three most commonly discussed recovery scenarios. Those are the V, the L, and the U.

10:23 If we turn our attention to the next slide, the V-shaped recovery, as it implies, is probably the most optimistic scenario. This assumes that there’s this rapid recovery in spending and in jobs that come back as these lockdown orders in place kind of ease. Rules get relaxed. The analogy I’ve heard is that this almost like a snowstorm that hit the global economies. Much like a snowstorm, when you’re stuck indoors, eventually the storm passes. People come out and things continue on. You have a rapid recovery and economic activity.

11:03 Initially, this was probably was the most discussed scenario. One of the reasons why is that our economy, at least domestically, was an extremely resilient and in great shape pre-COVID 19. Unemployment was 3.5% and GDP growth, maybe not extremely strong, but was solid. All these other measures looked pretty healthy with our own economy. The idea is that gives weight that once the coronavirus issues are ultimately resolved, you could see a rapid recovery back to some sort of normalcy.

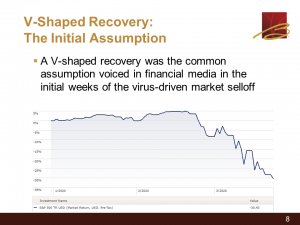

11:44 What’s interesting on the following slide, you’ll see that this was the initial scenario that was discussed. If you read a lot of the financial press, you saw a lot of “talking heads” and economists discussing this idea of a V-shaped recovery. This would be a sharp, but ultimately short-lived sell-off in both the markets as well as the economy. We’d hit some bottom with virus issues that would get resolved, then we’d have a rapid recovery. Things would go back to normal fairly quickly.

12:18 What’s interesting is while this was the common scenario, at least that I could see was constantly being discussed, the market was heading in the opposite direction. While the scenario of what was going to happen was very optimistic, the market action which was a severe and sharp sell-off, was quite the opposite.

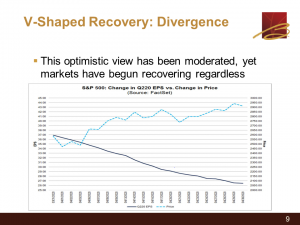

12:39 We then hit a bottom on March 23rd, and as you’ll see on the following slide, as measured from pretty close to the bottom, stocks just shot up at an amazing speed. At the same time stocks were shooting up, this idea of a V-shaped recovery, the optimism for it really moderated quite a bit. It’s interesting to see when the “talking heads” were very optimistic on a V-shaped recovery, stock prices were completely tanking. Then when you saw that optimism for a V-shaped recovery recede, you saw a pretty sharp snap back in stock prices.

13:24 Meanwhile, analysts that look at the underlying stocks in the stock market and try to predict their earnings, in aggregate were actually cutting their earnings forecast quite a bit. You can see by this solid dark blue line. Again there’s a divergence between what this recovery and stock prices that we’ve seen since about mid-March, and the actual projected with corporate results of the constituents in the stock market. That is a bit of a disconnect and it is something that I’m certainly paying a lot of attention to. On the face of it, it does seem to be somewhat of a contradiction, but nevertheless that is where we find ourselves today.

14:09 As we turn our attention to the next slide, another potential recovery (and this is the most pessimistic recovery path) would be an L-shaped. The shape of the letter implies that you have a really sharp decline, you hit a bottom at some point, but there’s not really much recovery. It goes mostly sideways, maybe a slight pickup, but you see an extended period of slow to no economic rebound that carries on for several years. The reason that some people feel this could happen is the idea that stems from the shocks caused by these global lockdowns, all of the job losses just in our own country, that we’ve read about. Unlike a snowstorm that passed and everyone goes outside again, the storm passed but no one goes out. Everyone stays home and there’s never really a rebound. Again, the culmination of the damage caused by efforts to fight the coronavirus. Even when the coronavirus might recede, you won’t really see much of a rebound because you have this built-up damage that just can’t be recovered very easily in at least the short to medium term.

15:34 There’s some element of a psychological change as well. It’s not just to say that there’s perhaps real financial damage that you could measure, but also you might get a psychological shift. People, for quite a while, might be hesitant to go out and spend, which would make a recovery pretty difficult. This would not only be for consumers, but business investment as well.

15:59 On the following slide, we’ll see again with this L-shaped recovery what could trigger it besides those general topics that I just discussed. There are some specific things like corporate defaults. Certainly if you saw a large number of corporate defaults (if the companies default and liquidate because declaring bankruptcy doesn’t make the business disappear necessarily), and if the businesses aren’t around then they’re not going to be rehiring people when the shelter in place orders recede. That would obviously hinder any kind of recovery.

16:39 On a positive note, the Fed has really stepped in and provided a lot of support very quickly overall to the financial system. There was a period in March when the stock market looked pretty grim. You could see a high level of liquidity stress (the lack of liquidity). The Fed stepped in, almost like waving a magic wand, and has resolved this at least for now.

17:08 But, I like to make the analogy that this is like a sick patient that suddenly runs out of air. Liquidity is like air or blood circulating around. If you halt that circulation, things kind of lock up and ugly things happen. The Fed stepped in and restored this liquidity, but what they can’t do is fix solvency problems. The Fed can make sure the financial plumbing keeps working, but ultimately if you don’t have any customers your business won’t survive regardless of what the Fed does.

17:41 We’ve solved, at least for now, the liquidity issue. Now our attention will turn to the solvency issue and what happens, and this can take quite a while to play out. Some initial victims have been in the retail space, and oil or energy space. For example, JCPenney, J.Crew, Neiman Marcus. There are other firms that are potentially discussed like Macy’s that are under pressure and ultimately may have to file for bankruptcy. In the energy space, Chesapeake Energy is another one that’s mentioned.

18:18 What’s interesting is in both retail and energy those sectors were already stressed for years. People had pretty low optimism. It’s always good that if something bad happens in an environment of negativity because at least there’s no high expectations to be shattered. Noone really had high expectations for the retail space or the energy space. There’s been years of struggles there, so it’s no surprise to see that now with this coronavirus induced economic decline, you’re seeing a lot of stress which is pushing some companies to the breaking point.

19:00 There are a few new areas of concern. Anything connected to travel, like Hertz Car Rental Company may file for bankruptcy. Restaurants, although most of them are not publicly traded, there are a few that are operators of national restaurant chains. At this point, those are things that are pretty well known.

19:25 The question is more what is not priced in? What negative event could happen that markets aren’t really aware of that could really shatter expectations?

19:36 On the following slide, we can see a few potential areas and that’s certainly not an exhaustive list of what could happen. A few potential things to look out for would be a really high level of consumer defaults. We know pretty much at this point that there will be an uptick with auto loan defaults, credit card debt, student loans, etc. We know that will happen, but the question is how high will that get? There’s a certain level that happens in every recession and wouldn’t be out of the ordinary, but if you had a tsunami of defaults that would be a pretty severe negative event.

20:16 Other potential issues would be if the recently re-sparked, but certainly not new, China/US conflict. It’s evolved to being a coronavirus issue but we knew from the previous two years that President Trump has been seemingly “picking a fight” with China and tariffs, etc. We’ve discussed quite a bit in previous client communications, but if that reached some kind of boiling point and spilled over that would be a serious negative economic trigger. That would certainly hinder a recovery.

20:53 Another unique thing that’s happening, that’s interestingly enough not new and is several years old, is there’s a spark with the European Union and largely connected to Italy. Southern Europe, which has been a problem within the European Union for quite some time, after the financial crisis there’s a new friction emerging because Southern Europe is getting hit very hard with the virus compared Northern Europe. They feel like, and for frankly some good reasons, they’re not being treated fairly by their European Union neighbors there. There was some masks, I believe early on, that weren’t getting shipped to Italy where companies were holding them for themselves. It’s really centered around Italy at this time, but potentially Spain as well, could join in this issue. There is a lot of friction and of course high enough friction could cause a fracture within the European Union, which would be a severe negative event.

22:01 Another potential issue that could certainly hinder any kind of economic recovery would be a pretty widespread banking crisis. After the 2008 global financial crisis it’s pretty widely regarded that the US banking is still in a pretty healthy shape. One banking system that never recovered well was also the European Union. They’ve been languishing and they never really got their feet back. You can imagine that this new crisis could lead to quite a lot of problems and if escalated and created some negative feedback loop, there is a risk that you’d see a full blown crisis. That would obviously hinder a recovery in the global economy.

22:48 Finally, on the next slide, this is the last scenario I’ll cover of the three, which is a U-shaped recovery. The name of the shape implies you’re going to get a fall, find some bottom (and it may not be found that quick) then some type of initial recovery. Then it drags on and on and things do recover, but it’s at a pretty slow pace There’s no quick V-shaped rebound back to normal. This seems to be what’s being discussed now as the most likely scenario for the economy. You take years to get back to full normalcy. You may still see some initial increase in economic activity, as these shelter-in-place orders end. You see some jobs being restored, some spending being restored, which we’ve actually seen to some extent with spending. But, you don’t get all the way back to normal and it takes years to get back to where GDP per capita was in 2019. That’s what a U-shaped recovery is.

24:03 On the next slide, we’ll see what evidence is there and why this may occur. Absent a vaccine, it’s pretty logical that certain types of economic activity won’t be restored any time soon. Sporting events, conferences, business travel, restaurants (even if they reopen at half capacity, that’s still not any kind of normalcy). It’s easy to see that there will be certain types of economic activity that won’t come back anytime soon. If that does occur, then you will not get any kind of V-shaped recovery as these parts of the economy languish and take quite some time to fully recover.

24:50 I think the biggest one, and this is a recurring theme with a lot of these with the previous two scenarios we discussed, is really hanging on the consumer. What happens with consumers when shelter-in-place orders end? Do they get their jobs back? How do they spend? Not only making up for missed debt payment, but making up for lost income relative to the shelter-in-place reduced hours. Or, just flat out not having a job. Missed rent payments. Imagine you don’t have a job for three months and you do find one after shelter-in-place ends. You still may have three months of rent you have to make up, and therefore you’re probably not going to go buy a new iPhone anytime soon.

25:37 Psychologically, even if you have the resources, will you just be more cautious going forward? Which would hinder a recovery. You would still get it but it would just slow it down at the margin. Keep in mind that consumer spending is about two-thirds to 70% of our economy.

25:55 On the next slide we’ll see, given those three scenarios, what is our estimate? At Bell, we’re definitely in the U-shaped camp or something similar to a U. Most likely with an initial pop in economic activity as the lockdown orders subside. What I would like to point out is that since we’ve never seen past pandemics, and never seen global shelter-in-place orders all over the world forcing economies to largely shut down. Since we’ve never seen it before we don’t have other examples we can look to use as a guide. That means uncertainty right now is extremely high about what the recovery will look like.

26:41 I’d point out that there’s companies diverse as IBM, Abbott Labs, and Fedex that have pulled their guidance. They feel so uncertain about their own operations. Uncertainty doesn’t mean bad or good. It’s just uncertainty with a question mark. It could be good or could be bad. But, they have such little insight to the future they’ve actually stopped issuing guidance on what their future corporate results will be.

27:10 I point that out because this is to predict what’s going to happen for the economy and the aggregate when companies can’t even give guidance on their own operations, that’s a pretty startling result when you see it happen. This is not just in one company but a lot of companies. That’s a pretty good example of how much uncertainty there is.

27:33 On a final point I’ll say we’ve been discussing economic recoveries. That is not necessarily the same as the stock market recovering. The path of the economy or economic activity is likely to be desynchronized with equity prices and how they move. We know as we’ve discussed before that markets are forward-looking. They try to incorporate new information and they try to predict changes in direction before you necessarily see it in the underlying data. Sometimes they think there’s a recovery, then the data comes out and they realize they’re wrong. They kind of have these false bear market rallies. Just because you think a certain economic activity path is going to happen that doesn’t mean the stock market itself follows lockstep with that same shape. Just something to keep in mind.

28:31 With that, let me turn things over to my colleague Laurent. He will discuss more about client portfolio actions that you may or may not want to take during this coronavirus pandemic.

28:41 Laurent: Great, Ryan! That’s a great segue into the next slide. Ryan has just talked about three different possible economic recoveries and just mentioned that markets don’t really follow those economic recoveries. They are either delayed or really they’re forward looking. Great question from our clients, and really the public, is what should I do about my investments today? And really, how are you feeling about those investments?

29:17 I’m going to talk about the market itself and then get into a number of options that you should think about. As Ryan mentioned, while the economic recovery may be in process, stock markets are doing some different things, there’s going to be a fair amount of volatility moving forward both up and down. It’s important to understand what you should do.

29:46 Taking a look at points Ryan made earlier, the US stock market valuation looks really, really expensive. Something called the price-earnings ratio (or P/E) is something that’s discussed quite a bit in the trade and in the press. Right now, it’s above 20 times earnings. When you take a look at that, it’s important to remember that pre-pandemic, we were actually at about a 19X and right now we are at 20X.

30:14 One of those reasons that we are higher than pre-pandemic is because S&P 500 earnings are expected to be quite low. Compared to where the stock prices are today of the S&P 500, that basically causes for high valuation. One of the things that could mitigate high valuations would be a very sharp rebound and expected future US corporate earnings. That would really help significantly and would tie in that V-shaped economic recovery, then tie into a V-shaped market recovery as well.

30:52 As Ryan mentioned earlier, some of the positives of the market is that the US economy is very fundamentally strong in early 2020 prior to the pandemic. There’s certainly still a hope for resilience and a recovery post-pandemic. The question is really how quickly will we get back to there?

31:13 Bell’s perspective is that it’s going to take a little bit of time. A little bit more like that U-shaped recovery that Ryan talked about in the economy. We think we might see maybe a W-shaped recovery in the stock market. We’ve certainly seen a very strong rebound but where are we today?

31:34 Markets vs the US Economy. I’ve talked with a number of our clients, and some of them may be very optimistic about the economy in terms of its ability to recover. Some are not so optimistic and are quite pessimistic. Something to keep in mind when you do investments, in stocks and in bonds, is the likelihood of stocks beating bonds over the next few years (especially over a long time horizon) is probably still high. That’s been true historically.

32:07 Where interest rates are today, they are very low and likely to stay low. That is designed by the Federal Reserve to really try and help us and try to spur economic activity. One example of that is the US Treasury 10-year bond yield right now it’s at a multi-decade low. It’s below 1%. The idea that as the economy revives, and because we’re spending so much money to get that economy back in shape, that could actually trigger inflation eventually. When inflation is triggered, usually the Fed steps in and starts to raise interest rates again.

32:51 Where interest rates are today, bonds may not do quite as well in a rising interest rate environment. That is something to keep in mind as you take a look at markets. Ryan mentioned this earlier, stock markets are forward-looking. In fact, we see the stock market in a very rosy picture. That picture is that a vaccine may actually come sooner than expected. There may be some cure sooner than expected. That’s what stock markets are pricing in, we think, currently.

33:26 Something else to keep in mind is that stock markets are always incorporating new information, and they are able to look past some of that economic pain that we will be going through in the next three months.

33:39 One thing we like to do at Bell is we like to work with our clients and really ask our clients to look forward, not necessarily in the next three months or six months, but really looking forward to the next several years (especially with their longer term investments). What do investment options look like today for the next five plus years? Bond returns are likely to be much lower than historical averages. Future stock returns are likely to be higher than those bond returns, but quite volatile both on the upside and potentially on the downside. When you have ultra-low interest rates that definitely makes those bond investments on average lower than expected from a historical perspective. You have to keep the investment landscape in mind as you’re looking overall over the next few years.

34:48 The question now, when you take a look at that landscape is how much risk should I have in my portfolio? One of the important questions to ask yourselves is how are you feeling? Did you have any discomfort during the stock market downturn in March? Or did you feel a bit of that euphoria in the April recovery? Are you sleeping okay? Are you looking at your portfolio a little too often lately to see if it’s up or down?

35:09 That, in addition to looking at investments that you may need to liquidate short term because you’re feeling a little bit of pain on the cashflow side. Or, you have actually put in some cash in the market mid to late 2019 or early 2020 as many people were starting to have that euphoria or feeling a fear of missing out (FOMO) that may have been before the pandemic and the stock market downturn. Those may be signals that you maybe have too much risk in the portfolio.

35:45 That brings me to the last segment of the webinar. It’s going a little bit longer but I think these next four slides are really important. With portfolio options, there are really four choices.

Number one, we’re going to start with the recommended portfolio option which is to stay the course. Hopefully we are in the right risk profile and didn’t feel too much discomfort. Of course all of us feel discomfort when the market goes down. But staying the course is really something that you can have a little bit of discipline on and focus on. It really does show time and time again that it’s the best option for long term performance.

36:25 A couple of tips to stay the course is to avoid looking at your portfolio every day or every few days. That really leads to worrying about or thinking about the portfolio too much. That’s what you’ve hired us to do, which is to make those important decisions. We really are looking at your investment portfolio every day and every week, making sure that we’re taking the right steps.

36:54 The other thing is that we are heading into the summer. Typically those are times when you take a summer vacation, so take a statement vacation this summer. Try not to look at that often.

37:06 On the other hand, we do recognize that there are some situations where you may not have had enough money in your emergency reserve. Or you may have an unexpected situation happen over the last few months. For example, you might have been furloughed or you might have lost your job. There are some changes you can make today which we would still recommend if you don’t still have that peace of mind and you really feel like you need some safe money.

37:35 Put one year’s worth of fixed expenses in cash if you haven’t done it yet. With the market recovery that we have experienced so far over the last month and a half, this would be a great time to do that. If you’re at RMD age, you’re over 70 and a half, and you’ve been taking RMDs for a few years, putting your one year’s worth of RMDs in cash is a great way to give you peace of mind and to ride out the volatility in the market. In addition to that, move another year of all of your budget expenses (not just your fixed expenses) into the lower risk bond investments. Those would be bond investments that are safer higher-quality bonds, maybe shorter duration. Potentially with that, you could have from one to three years of relatively safe investments that you have available to you weather stock downturns. When you take a look at downturn averages, how long that they last, typically US stock market downturns have averaged 18 and 24 months. The idea is that you have safe money to get you through the volatility and the downturn, then on the other side you can access some of those stock investments after the market is in it’s recovery mode.

38:54 In some cases, and it’s not recommended, you may need to make a much bigger change to decrease your current investment risk, maybe to the point where you weren’t able to swallow the volatility. You really need some of those investments in cash. If you’re in that situation, we are here to help out. It’s not necessarily recommended, but you could put a year of fixed expenses in cash. You’d have at least two years’ worth of all of your expenses in bonds, bond funds, or cash. That has to be a very conservative move, but you’d have those three years’ worth of expenses in cash and/or safe bonds.

39:38 Lastly, you might want to move some of those higher risk stock positions. Maybe you were concentrated in Amazon, or in one of the airlines, or in some stock options. You’d want to move some of your higher risk positions into maybe some blended stock bond funds or into something that’s less risk.

39:58 We mentioned this was an option, but really we strongly recommend against this. This is essentially selling a substantial amount of your higher risk positions to cash. When you do that, it is known as market timing. You could be 25, 50, or 75%. You sell everything to cash. The challenge with this option is it’s really difficult to figure out when to jump back in.

40:29 For example, if you have gone to cash on March 23rd you would have missed a very large recovery in the market. Again, it’s not a bad time to look at your portfolio today, check with your Bell investment advisor, and maybe make those slight changes creating that emergency reserve and some bond investments to tide you over.

40:53 Market timing, traditionally, really does not work. The reason is the stock market under performance for most investors. I’m going to ask Ryan to come back on at this point and he’s going to cover conclusions and summary for the first two bullets here.

41:14 Ryan: Great, thank you Laurent. Just to recap, clients should expect further market volatility. We’ve already seen quite a lot of it, but if you look historically how long do downturns take to play out they are typically measured in years not in a couple of months. While we have seen a healthy recovery already, there’s no guarantee we won’t go back down or even make new lows. I would caution clients to prepare for that mentally.

41:47 What kind of recovery we are likely to see (the firm’s best estimate) is that we will have a U-shaped recovery. There is a lot of uncertainty given that we’re experiencing things that we haven’t experienced before, so we don’t have much of a guide to go off of.

42:06 Laurent: Thanks, Ryan. I just finished chatting about volatile market movements and what kind of portfolios may have too much investment risk. It’s important to make sure you’re comfortable with your portfolio risk. Again, if you can do it, staying the course or making those smaller changes is best for the improved long-term performance and your financial plan as well.

42:33 Forrest, Ryan, and I wanted to thank you for attending the webinar today. The team members are here to support you. As Forrest mentioned in the beginning, we’re fully operational with our entire team working from home during the shelter-in-place process here. We do wish you a safe and healthy 2020. If there is anything you need please do give us a call. We’re able to answer your questions after this webinar so please make sure you get those questions to us. You can always contact us as well via email since we are at home here in shelter-in-place. Email is the best way to get a hold of us.

43:16 We will have another investment committee update sometime this summer. Right now it’s scheduled for July. Definitely stay in touch. This is a time where we really want to be in touch with all of our clients. If we haven’t chatted with you lately, but we chatted with you a couple of months ago, definitely give us a call or send us an email.

43:57 Ryan: Thank you so much, and we hope you found it informative.