With a new arrival to our family, my mother-in-law has been staying with us for the past couple of weeks. For my wife that means an extra helping hand with three kids, housework, and carpooling logistics. More importantly (i.e. selfishly), for me that means homemade tortillas, as my mother-in-law makes them about as delicious as I have ever had.

As we were enjoying a batch at dinner the other night, my four-year-old daughter was struggling to eat it as it flopped around in her tiny hands. To help, I offered, “It’s easier to eat when it’s rolled up—like a newspaper.” That suggestion elicited a blank stare, which made me realize that my kids have no clue what a newspaper is. At home, my wife and I receive all of our news from either television or our mobile devices, and at the office, I exchanged my Wall Street Journal subscription for a WSJ.com account a long time ago. That revelation led to some laughs among the adults in the room and a quick brainstorm on other once everyday items for which our young kids will likely never have much conception—records, cassette tapes, payphones, VCRs, and typewriters. Recalling the time my six-year-old son asked me how banks work, I also mentioned interest, as I had struggled to explain to him why people give banks their money. “For safe keeping” was about all I came up with as interest on liquid deposits is a relic of the past—at least for the foreseeable future.

QE3 Has Arrived

The major news out of September was that the Federal Reserve officially launched additional monetary stimulus via a third round of their quantitative easing program or “QE3” as it has become affectionately known. This new round of stimulus takes the form of $40 billion per month in mortgage purchases until the labor market improves, which means it can be considered open-ended. This is very aggressive stimulus and a bit unprecedented as the Fed typically specifies a projected end date.

The Fed is doing what it is in existence to do according to its dual mandate of full employment (a ~5% unemployment rate) and price stability, which they define as core inflation (i.e. consumer inflation less food and energy costs) of approximately 2% per year. Check on the latter; much improvement required on the former. So it is no surprise that the Fed is injecting more stimulus into the economy, but we see two potential issues that investors must be aware of in order to invest prudently in the coming years:

- Unemployment is more structural than cyclical at this point, so additional stimulus will not move the needle. Only job training will, and the Fed does not have the ability to do that. Only Congress does. The Fed suggests the stimulus may end in mid-2015, but there is a chance it could last much longer if the structural issues in the job market are not addressed and unemployment remains stubbornly high as a result. (For further discussion on structural versus cyclical unemployment, please read “A Cure for What Doesn’t Ail Us” at www.bellinvest.com/cure)

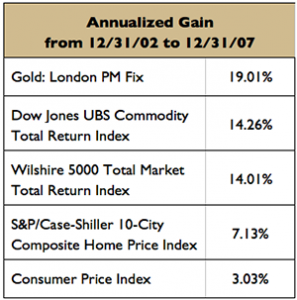

- Inflation does not just confine itself to consumer prices, which the Fed is focused on. Asset prices can and will take off too. Just look at the mild rise in consumer prices from 2003 to 2007 and the huge run up in stock, commodity, and real estate prices during that time (see table on next page). This was a result of the monetary stimulus injected into the economy by the Fed in response to the 2000-2002 bear market in stocks and the resulting recession, the amount of which pales in comparison to today’s level of stimulus.

Investment Implications

As a result of the start of QE3, we see an indefinite period of extremely loose monetary policy, which will likely result in asset price inflation rather than consumer price inflation. It is unlikely that consumer prices will take off without wage inflation, which itself is unlikely with elevated unemployment. Given this outlook, we think it is advisable to own investments that will benefit from asset price inflation. Stocks performed well in the first two rounds of “QE”, and we expect no different this time around. One look at the table above suggests adding hard assets like gold, commodities, and real estate to the list as well.

Along with creating a nurturing environment for risk assets, QE3 is also likely to result in a multi-year stable interest rate environment as the Fed intends to keep the lid on rates at least until mid-2015 or even longer if you support our view of a stubborn unemployment rate due to unaddressed structural issues. That means that you should put any “excess cash” (i.e. cash beyond what is needed for emergencies) to work in intermediate-term bond funds without much fear of rising interest rates. Just because my kids are oblivious to the existence of interest doesn’t mean that your cash should as well.