Developing a retirement plan used to involve a simple set of calculations. Any financial calculator could be used as a retirement planning tool: you could input a series of assumptions involving the present value of your assets, the future value needed at retirement, your retirement date, and an assumed annual rate of return. The calculator would then tell you how much you would need to save each year to accomplish that goal.

This retirement planning method—known as the “straight-line method”—is no longer utilized as the sole tool by professional planners. The reason is twofold: 1) no one earns the same rate of return every year from now until eternity, and 2) the timing of your annual gains and losses matters greatly to the ultimate success of your retirement plan.

The first reason for eschewing this method of retirement planning is obvious—financial markets are volatile; therefore the returns they produce are variable year-to-year. The second reason is not as intuitive. To illustrate, let’s look at a hypothetical example based on history (and history in reverse).

Assume an investor retires at the start of 1973 with $1,000,000 and a desire to produce $60,000 in annual inflation-adjusted income for as long as possible. With an all-equity portfolio based on the returns of the S&P 500 Index, that investor would run out of money two months into his 31st year of retirement.

Now let’s throw history in reverse. Using the same set of retirement assumptions, let’s invert the return sequence so that the investor works backwards—retiring in 2007 and having her 31st year of retirement end in 1977. This investor does not come close to running out of money at any point, and at the end of her 31st year in retirement, she has a portfolio worth over $5,000,000.

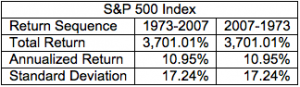

The only assumption we changed is the sequence of returns. Otherwise everything is the same including the total return, the annualized return, and the volatility of returns.

Clearly the timing of the gains and losses matters. The retiree who starts in 1973 and moves forward in time begins his retirement with a brutal two-year bear market that results in a decline of -37%. His portfolio never exceeds $1,000,000 again and starts out on an irreversible path to depletion.

On the flip side, the retiree who starts in 2007 and works backwards in time begins her retirement plan in a five-year bull market in which the S&P 500 gains 83%. While a serious three-year bear market follows that, the initial gains provide enough of a cushion for the portfolio to persevere. The end result is five times more money than she started with even after the 1973-74 bear market does its damage at the end of her retirement plan.

This is the reason the straight-line method is no longer utilized as the sole tool in retirement planning. Instead the core of retirement planning analysis is a Monte Carlo simulation in which return sequences are randomized to account for the fact that returns are variable and that the timing of those returns matters greatly to the ultimate success of your retirement plan.