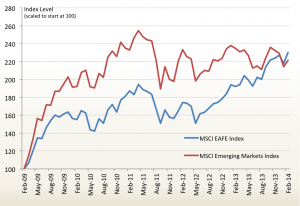

Up until 2013, emerging market stocks were riding the wave of the bull market that began just over five years ago in March 2009. And as you would expect for a higher-risk investment, emerging markets outperformed foreign developed markets in the first four years of the current bull market.

Then in 2013, in what was the best year for developed foreign stocks since the first year of this bull market, emerging market stocks managed to lose -2.3%, as measured by the MSCI Emerging Markets Index. That weakness carried forward into 2014 as emerging market stocks lost -3.4% in the first two months of the new year.

Foreign Stocks: Emerging vs. Developed Markets

February 2009 to February 2014

Bell FinBlog2014-9The problems date back to mid-2012 when year-over-year earnings growth for emerging markets turned negative. This stemmed in large part to China’s shift in economic focus from infrastructure investment to stimulating domestic consumption. Large emerging economies like Brazil, Russia, and South Africa that benefitted for many years from natural resource exports to China are now feeling the effects of China’s new economic agenda. As a result, the MSCI Emerging Markets Index has seen year-over-year declines in earnings per share growth in six of the last seven quarters.

With the interest rate spike in the U.S. in mid-2013, emerging market nations and corporations experienced a sharp uptick in their cost of borrowing as bond market investors quickly turned risk averse facing the prospects of a rising rate environment. The JPMorgan EMBI Global Index, a benchmark for emerging market bonds, saw its yield rise a full two percentage points—from 4.5% to 6.5% over the course of 2013. Such a sharp increase in borrowing costs only exacerbated the difficulty EM companies were facing growing their bottom lines.

When you add in the recent increase in geopolitical risk in Eastern Europe, the current environment has proven to be the perfect storm for emerging market stock weakness, a trend we view as likely to get worse before it gets better. As a result, we continue to avoid emerging market equity exposure.